2022 California Estimated Tax Worksheet - Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Use 100% of the 2025 estimated total tax. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Printable california income tax form 540es. Form 540es includes four estimated tax payment vouchers for use by individuals who must file.

Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Form 540es includes four estimated tax payment vouchers for use by individuals who must file. Printable california income tax form 540es. Use 100% of the 2025 estimated total tax.

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Printable california income tax form 540es. Use 100% of the 2025 estimated total tax. Form 540es includes four estimated tax payment vouchers for use by individuals who must file.

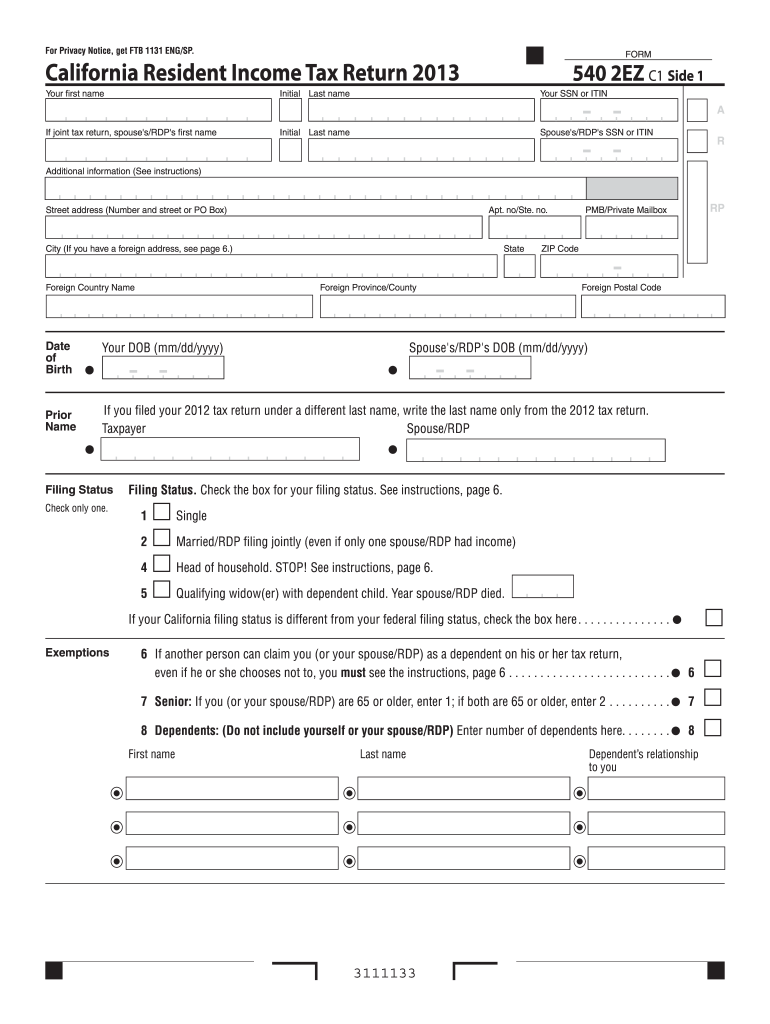

2024 California Estimated Tax Worksheet Juli Saidee

Printable california income tax form 540es. Estimated tax is used to. Form 540es includes four estimated tax payment vouchers for use by individuals who must file. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Use 100% of the 2025 estimated total tax.

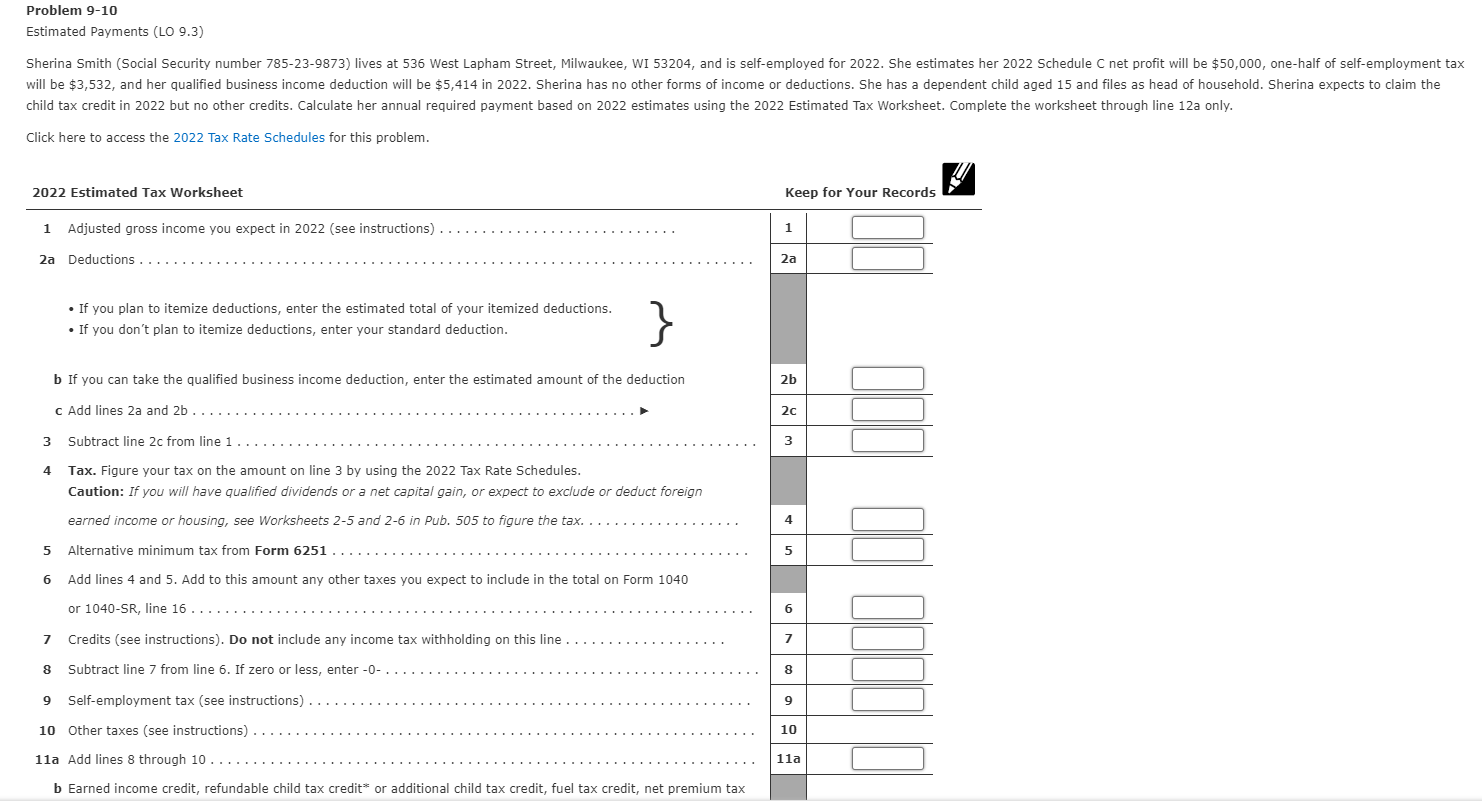

2022 Tax Calculation Worksheet

Use 100% of the 2025 estimated total tax. Printable california income tax form 540es. Form 540es includes four estimated tax payment vouchers for use by individuals who must file. Estimated tax is used to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in.

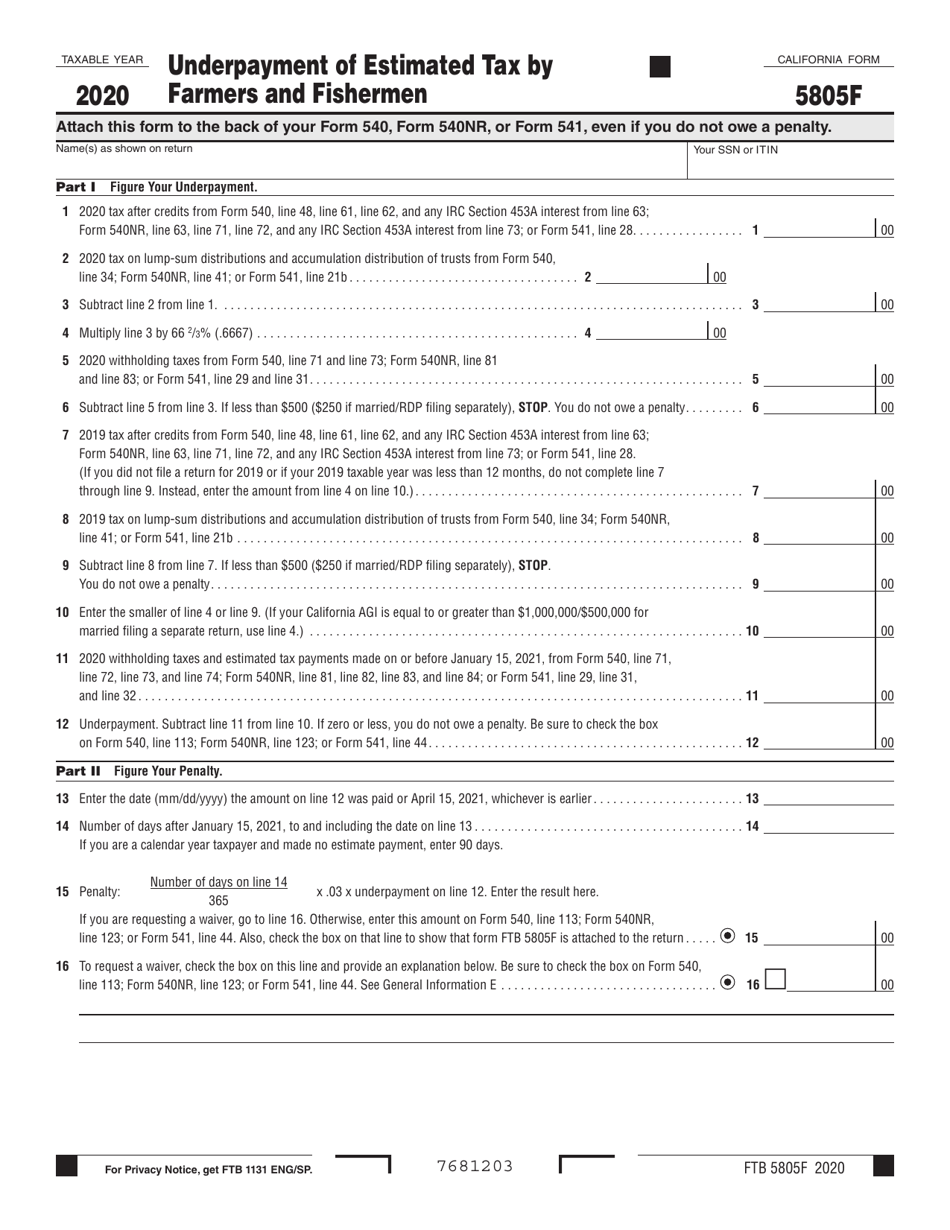

California Ftb Estimated Tax Payments 2024 Dorri Maible

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Printable california income tax form 540es. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Use 100% of the 2025 estimated total tax. Estimated tax is.

2024 California Estimated Tax Worksheet Alina Beatriz

Printable california income tax form 540es. Use 100% of the 2025 estimated total tax. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Form 540es includes.

Solved Estimated Payments (LO 9.3) child tax credit in 2022

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Printable california income tax form 540es. Use 100% of the 2025 estimated total tax. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Estimated tax is.

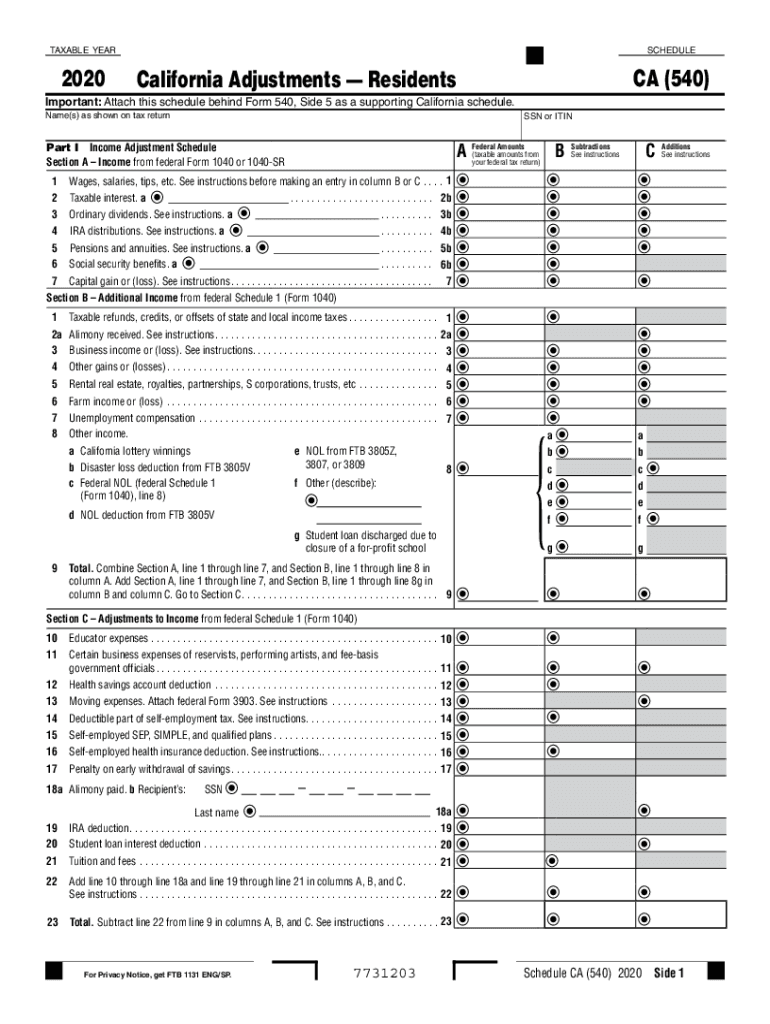

California State Tax Form Worksheet A

Use 100% of the 2025 estimated total tax. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Printable california income tax form 540es. Estimated tax is.

California Estimated Tax Worksheet 2024

Estimated tax is used to. Printable california income tax form 540es. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Use 100% of the 2025 estimated total tax. Form 540es includes four estimated tax payment vouchers for use by individuals who must file.

California Estimated Tax Worksheet 2024

Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Printable california income tax form 540es. Form 540es includes four estimated tax payment vouchers for use by individuals who must file. Use 100% of the 2025 estimated total tax.

California Estimated Tax Payments 2024 Forms Cori Lucine

Form 540es includes four estimated tax payment vouchers for use by individuals who must file. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages.

2022 California Estimated Tax Worksheet

Printable california income tax form 540es. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Form 540es includes four estimated tax payment vouchers for use by individuals who must file. Estimated tax is used to. Use 100% of the 2025 estimated total tax.

Form 540Es Includes Four Estimated Tax Payment Vouchers For Use By Individuals Who Must File.

Printable california income tax form 540es. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. Use 100% of the 2025 estimated total tax.