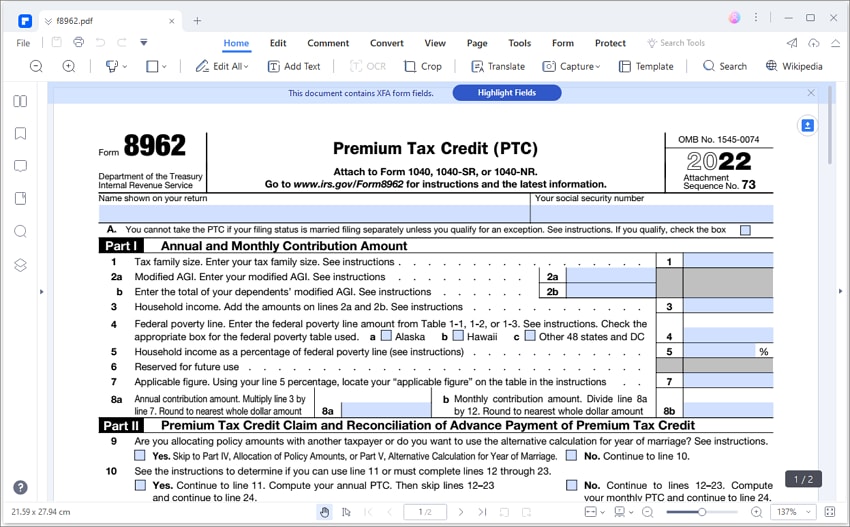

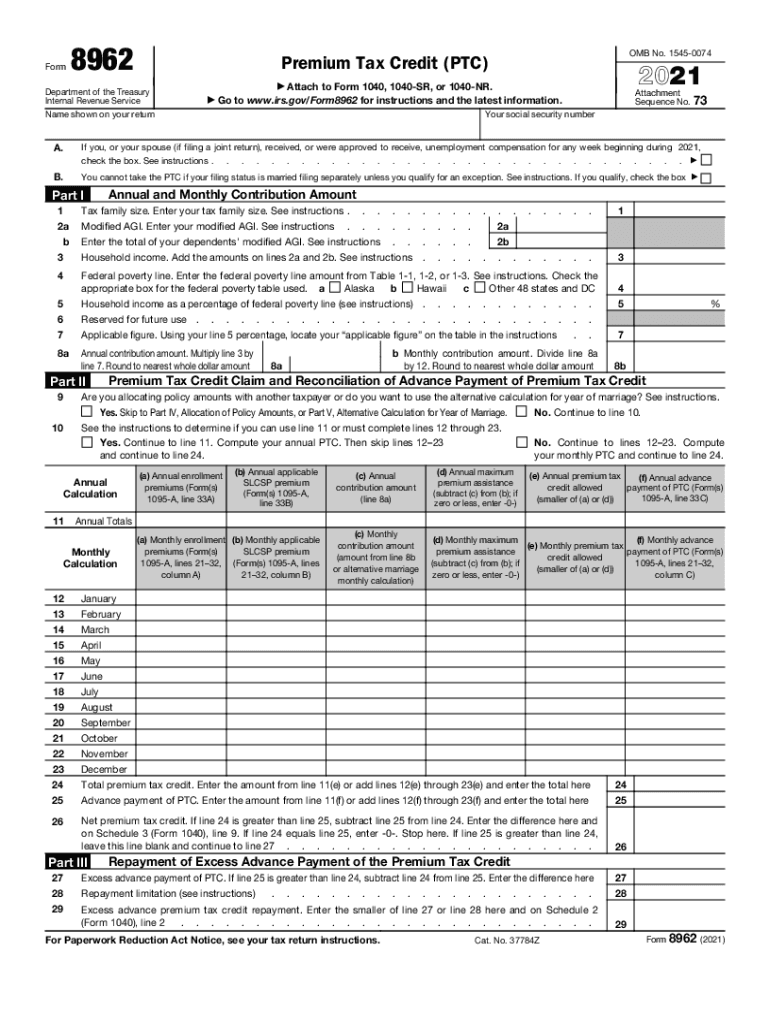

8962 Form 2021 Printable - You’ll need it to complete form 8962,. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. Use form 8962 to “reconcile” your premium tax credit — compare. 100k+ visitors in the past month This form includes details about the marketplace insurance you and household members had in 2024. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to.

100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. You’ll need it to complete form 8962,. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. This form includes details about the marketplace insurance you and household members had in 2024. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to.

This form includes details about the marketplace insurance you and household members had in 2024. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. Use form 8962 to “reconcile” your premium tax credit — compare. 100k+ visitors in the past month You’ll need it to complete form 8962,. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to.

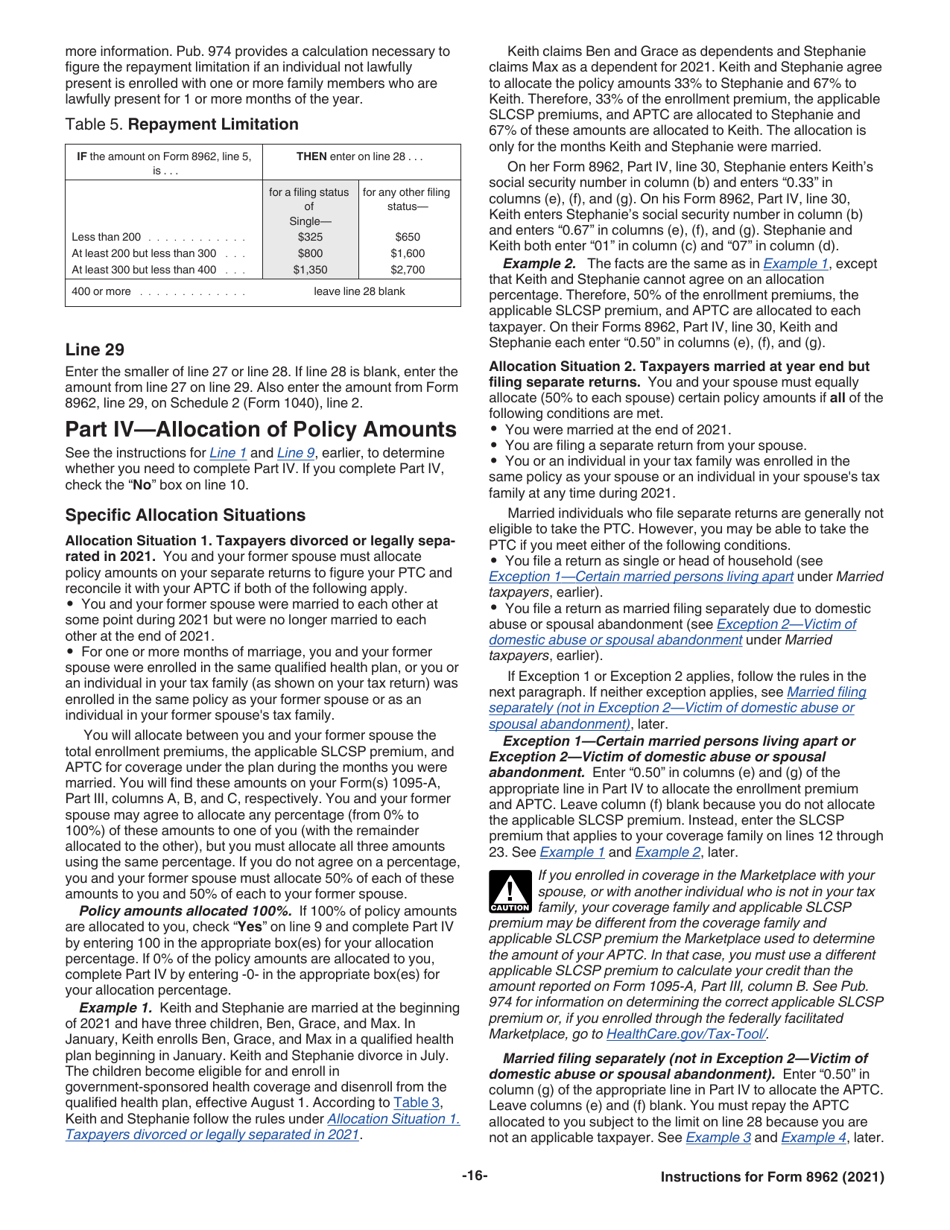

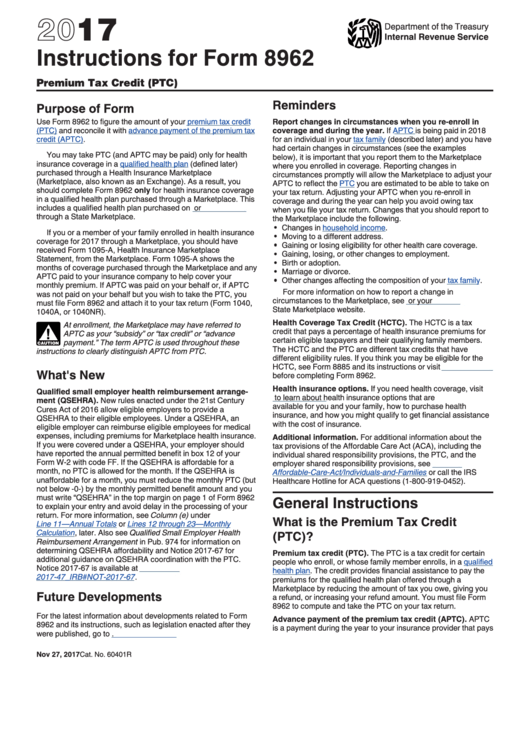

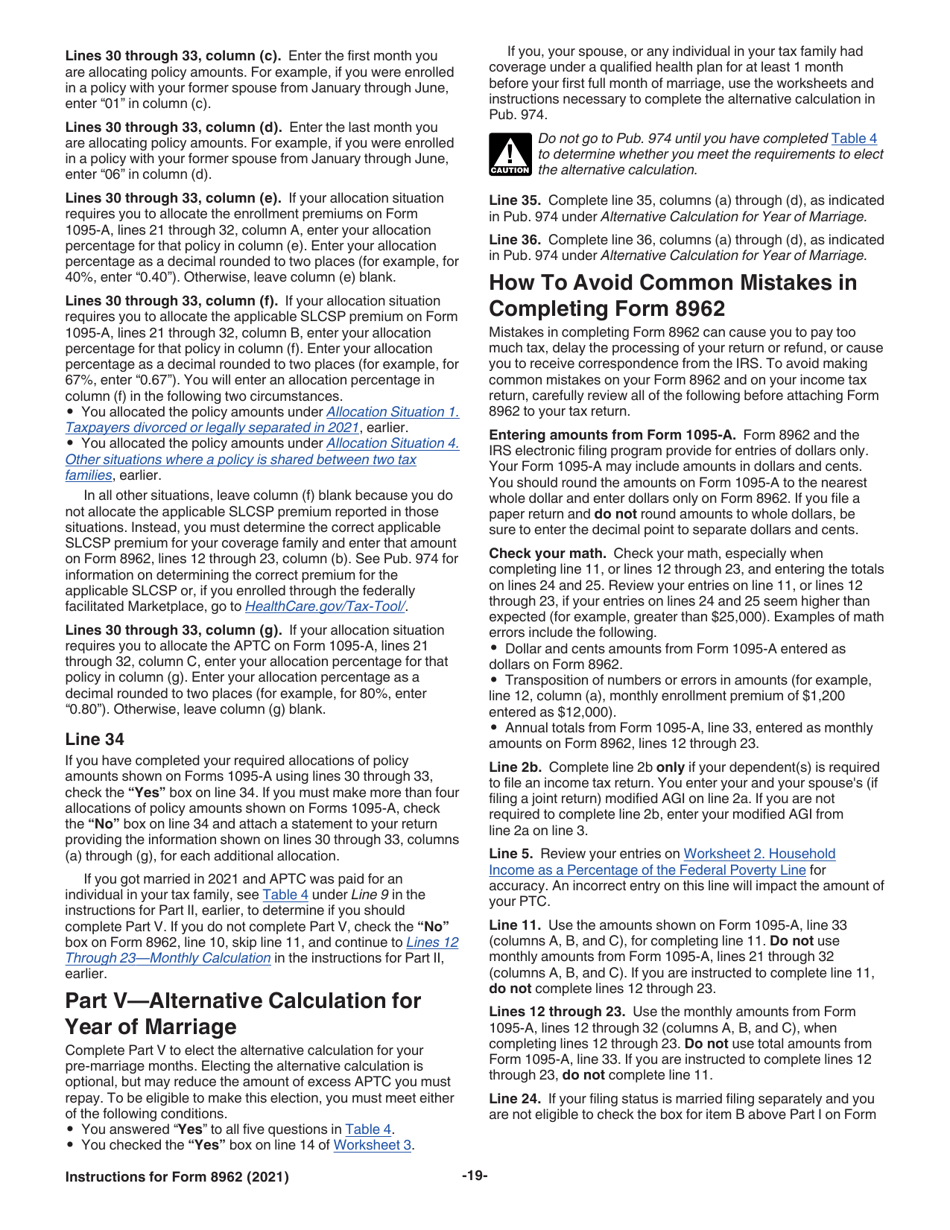

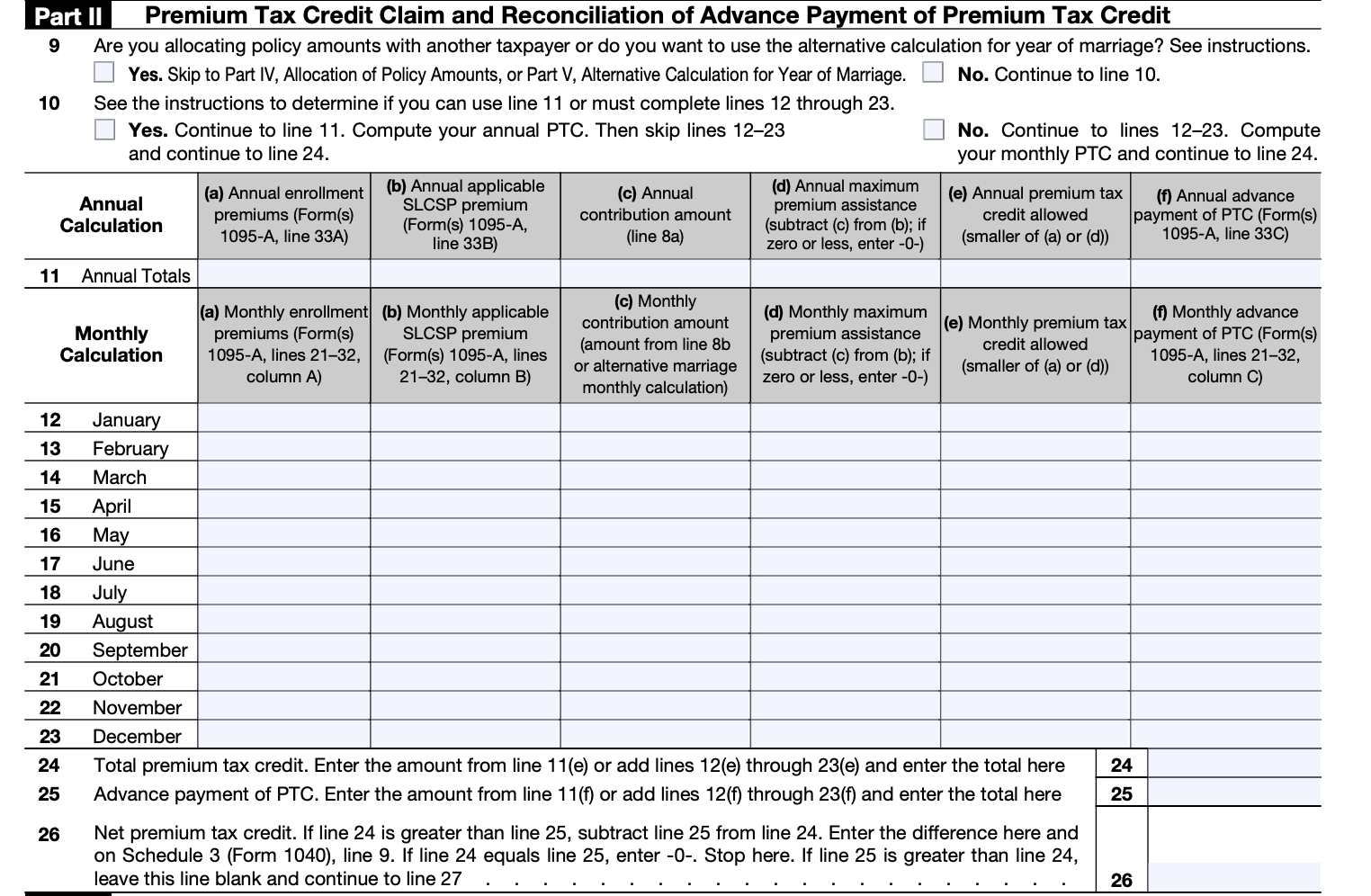

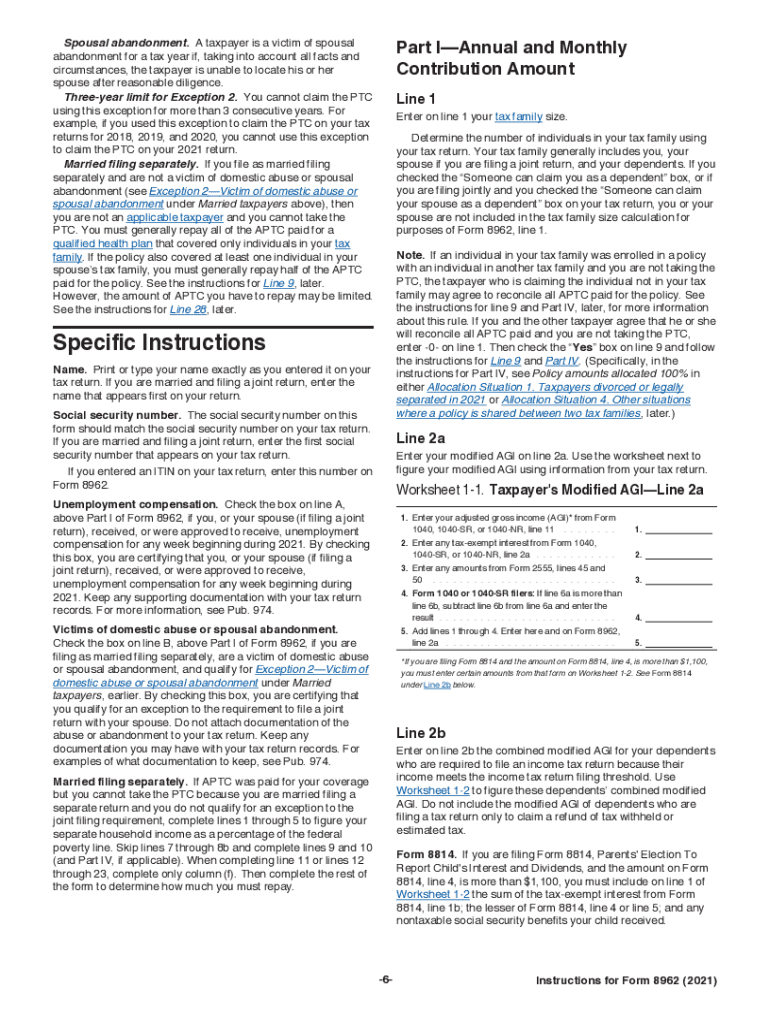

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

You’ll need it to complete form 8962,. Use form 8962 to “reconcile” your premium tax credit — compare. This form includes details about the marketplace insurance you and household members had in 2024. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to. Form 8962.

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

You’ll need it to complete form 8962,. Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay.

Tax Form 8962 Printable

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to. This form includes details about the marketplace insurance you and household members had in 2024. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax.

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

100k+ visitors in the past month Use form 8962 to “reconcile” your premium tax credit — compare. You’ll need it to complete form 8962,. This form includes details about the marketplace insurance you and household members had in 2024. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance.

Tax Form 8962 Printable

100k+ visitors in the past month Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to. You’ll need it to complete form 8962,..

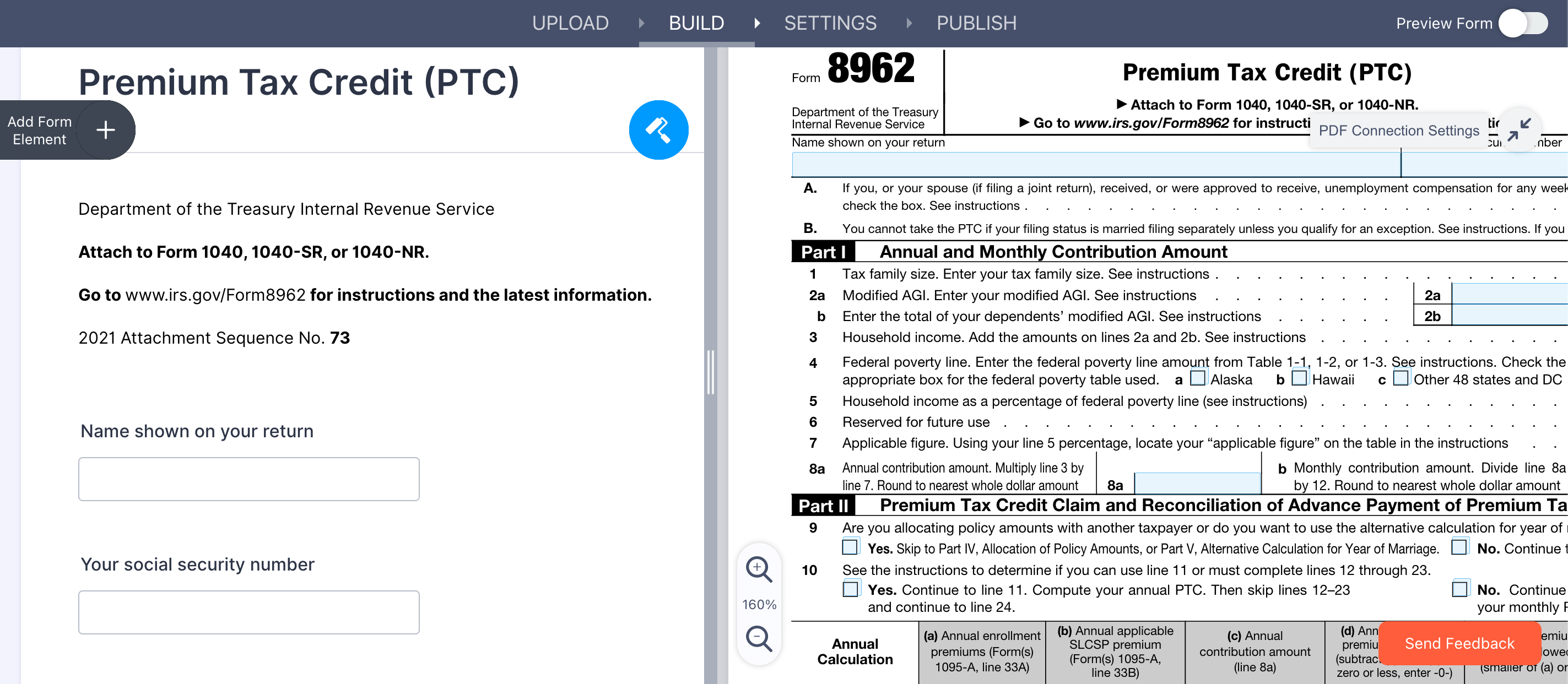

How to fill out Form 8962 online The Jotform Blog

Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. 100k+ visitors in the past month This form includes details about the.

All About IRS Form 8962 and Calculating Your Premium Tax Credit Nasdaq

You’ll need it to complete form 8962,. 100k+ visitors in the past month If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit.

2021 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Use form 8962 to “reconcile” your premium tax credit — compare. 100k+ visitors in the past month If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any.

IRS 8962 20212022 Fill and Sign Printable Template Online US Legal

Use form 8962 to “reconcile” your premium tax credit — compare. Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation. Form.

IRS Form 8962 instructions Premium Tax Credit

Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. This form includes details about the marketplace insurance you and household members had in 2024. If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see.

100K+ Visitors In The Past Month

Form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to. This form includes details about the marketplace insurance you and household members had in 2024. Use form 8962 to “reconcile” your premium tax credit — compare.

You’ll Need It To Complete Form 8962,.

If mfs but not eligible for relief, he/she is not eligible for a ptc and must repay aptc, subject to the repayment limitation.see part iv, allocation.