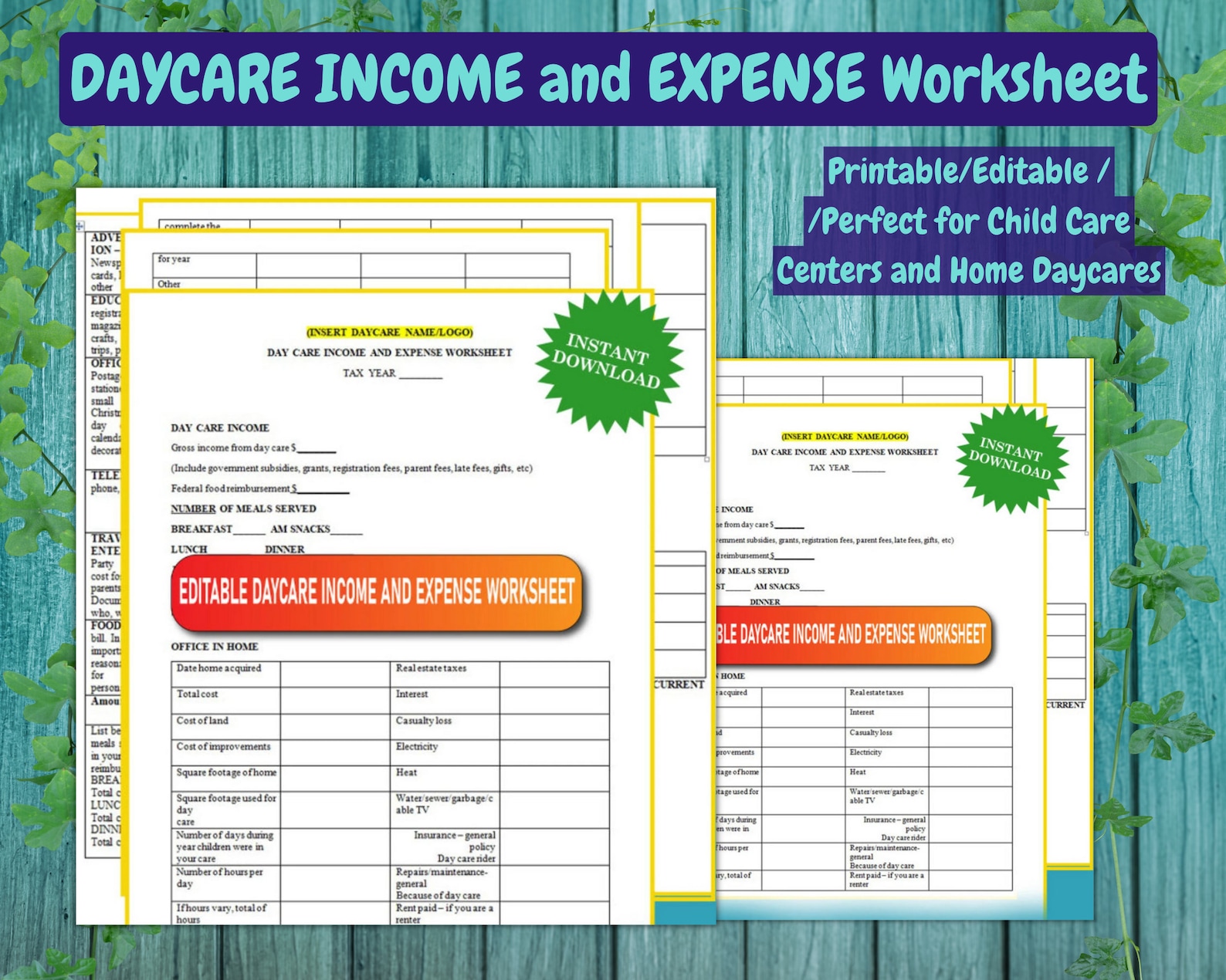

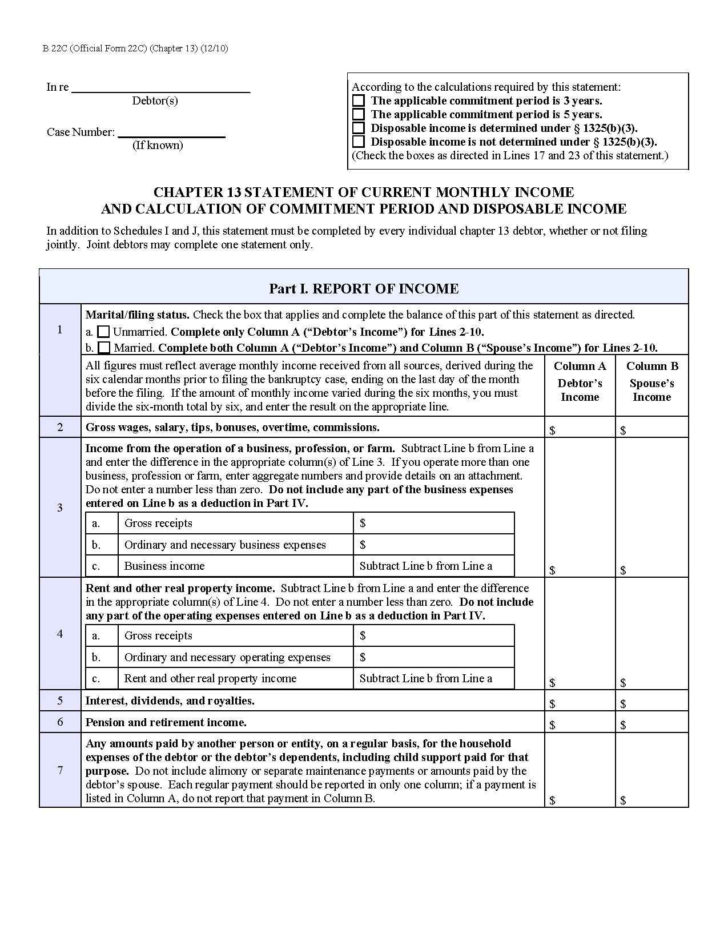

Daycare Income And Expense Worksheet - It collects crucial financial data to simplify tax. List below the number of all meals served. Both methods require a mileage log and/or expense. Irs has used the federal food program allowance to determine cost of food provided to the children. The irs allows two ways to claim the expenses for your business use of auto. This worksheet helps day care providers track their income and expenses for tax purposes. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your.

Irs has used the federal food program allowance to determine cost of food provided to the children. Both methods require a mileage log and/or expense. It collects crucial financial data to simplify tax. List below the number of all meals served. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. The irs allows two ways to claim the expenses for your business use of auto. This worksheet helps day care providers track their income and expenses for tax purposes.

Irs has used the federal food program allowance to determine cost of food provided to the children. The irs allows two ways to claim the expenses for your business use of auto. List below the number of all meals served. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. Both methods require a mileage log and/or expense. This worksheet helps day care providers track their income and expenses for tax purposes. It collects crucial financial data to simplify tax.

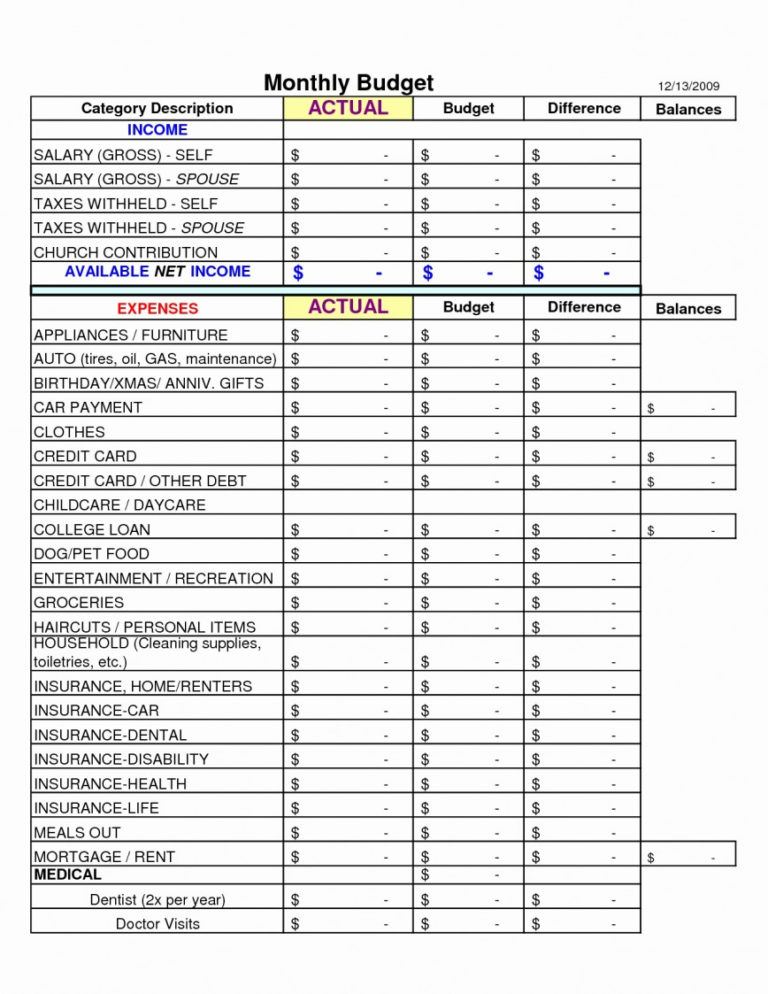

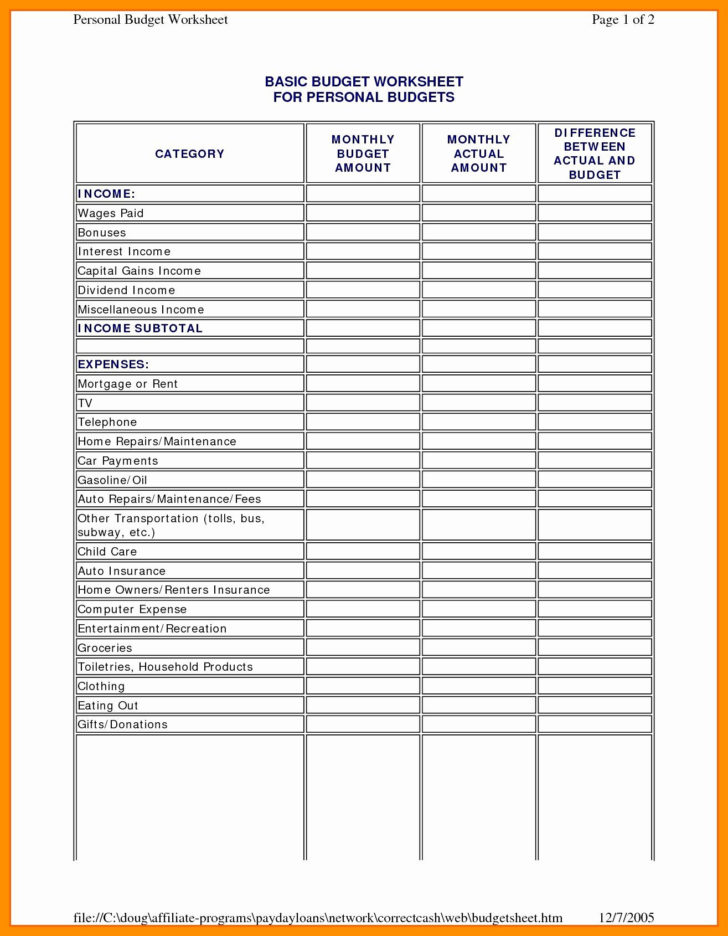

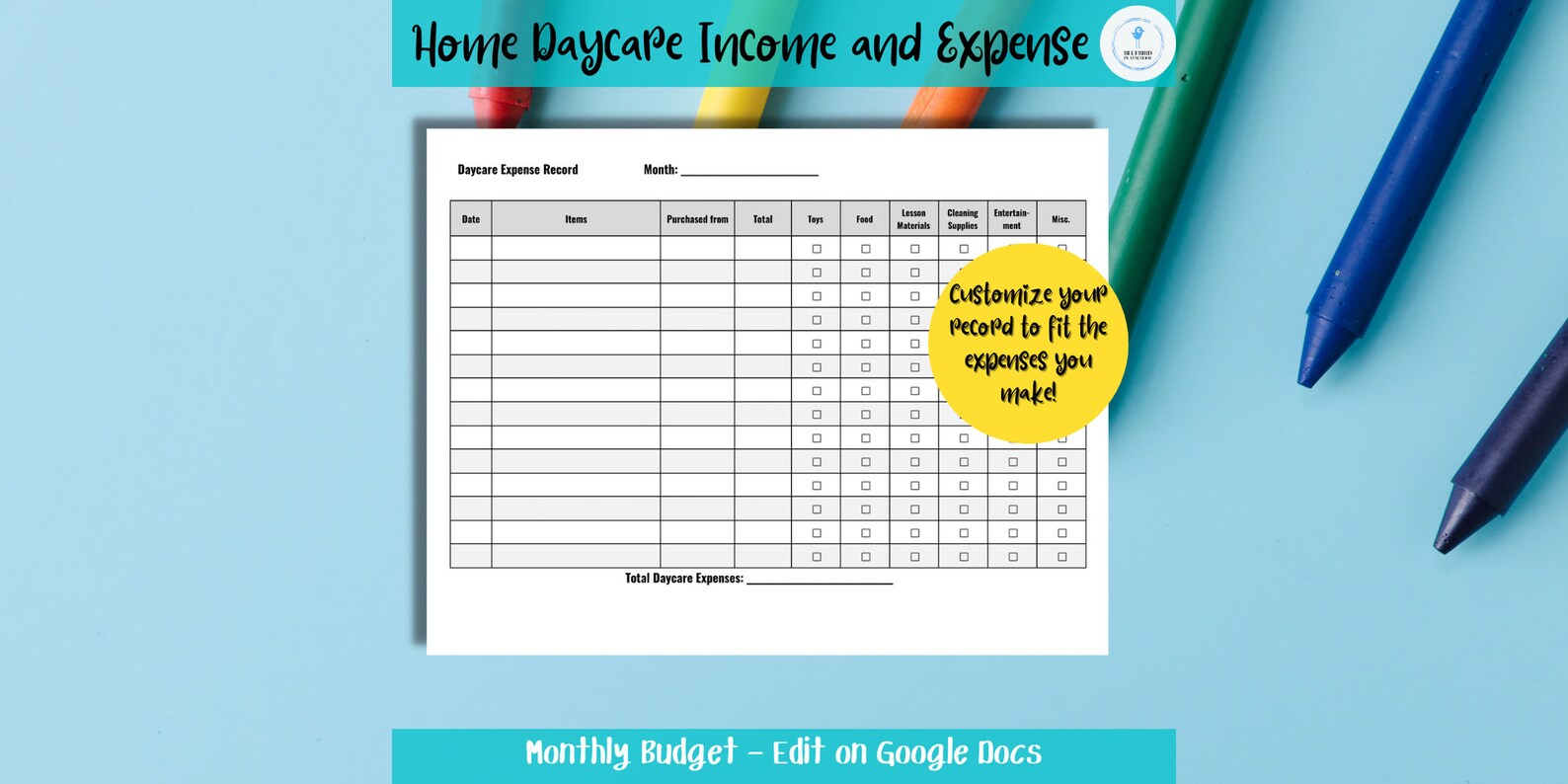

Daycare Expense Spreadsheet —

List below the number of all meals served. It collects crucial financial data to simplify tax. This worksheet helps day care providers track their income and expenses for tax purposes. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. Irs has used the federal food program allowance.

Home Daycare And Expense Worksheet —

It collects crucial financial data to simplify tax. The irs allows two ways to claim the expenses for your business use of auto. Both methods require a mileage log and/or expense. List below the number of all meals served. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of.

Day Care And Expense Worksheet

When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. The irs allows two ways to claim the expenses for your business use of auto. List below the number of all meals served. This worksheet helps day care providers track their income and expenses for tax purposes. Irs.

DAYCARE and EXPENSE Worksheet/daycare Tax Time/perfect Etsy

The irs allows two ways to claim the expenses for your business use of auto. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. This worksheet helps day care providers track their income and expenses for tax purposes. Irs has used the federal food program allowance to.

Printable Daycare And Expense Worksheet Printable Word Searches

List below the number of all meals served. Both methods require a mileage log and/or expense. Irs has used the federal food program allowance to determine cost of food provided to the children. It collects crucial financial data to simplify tax. This worksheet helps day care providers track their income and expenses for tax purposes.

Fillable Online Daycare And Expense Worksheet Fill Online

List below the number of all meals served. Irs has used the federal food program allowance to determine cost of food provided to the children. The irs allows two ways to claim the expenses for your business use of auto. This worksheet helps day care providers track their income and expenses for tax purposes. It collects crucial financial data to.

Home Daycare And Expense Worksheet —

Both methods require a mileage log and/or expense. The irs allows two ways to claim the expenses for your business use of auto. This worksheet helps day care providers track their income and expenses for tax purposes. List below the number of all meals served. It collects crucial financial data to simplify tax.

DAYCARE BUDGET SPREADSHEET to Track Annual and Expenses for

The irs allows two ways to claim the expenses for your business use of auto. It collects crucial financial data to simplify tax. List below the number of all meals served. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. This worksheet helps day care providers track.

Home Daycare and EXPENSE RECORD, Monthly Budget Worksheet

Irs has used the federal food program allowance to determine cost of food provided to the children. The irs allows two ways to claim the expenses for your business use of auto. Both methods require a mileage log and/or expense. This worksheet helps day care providers track their income and expenses for tax purposes. It collects crucial financial data to.

Home Daycare And Expense Worksheet —

When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. This worksheet helps day care providers track their income and expenses for tax purposes. Both methods require a mileage log and/or expense. It collects crucial financial data to simplify tax. The irs allows two ways to claim the.

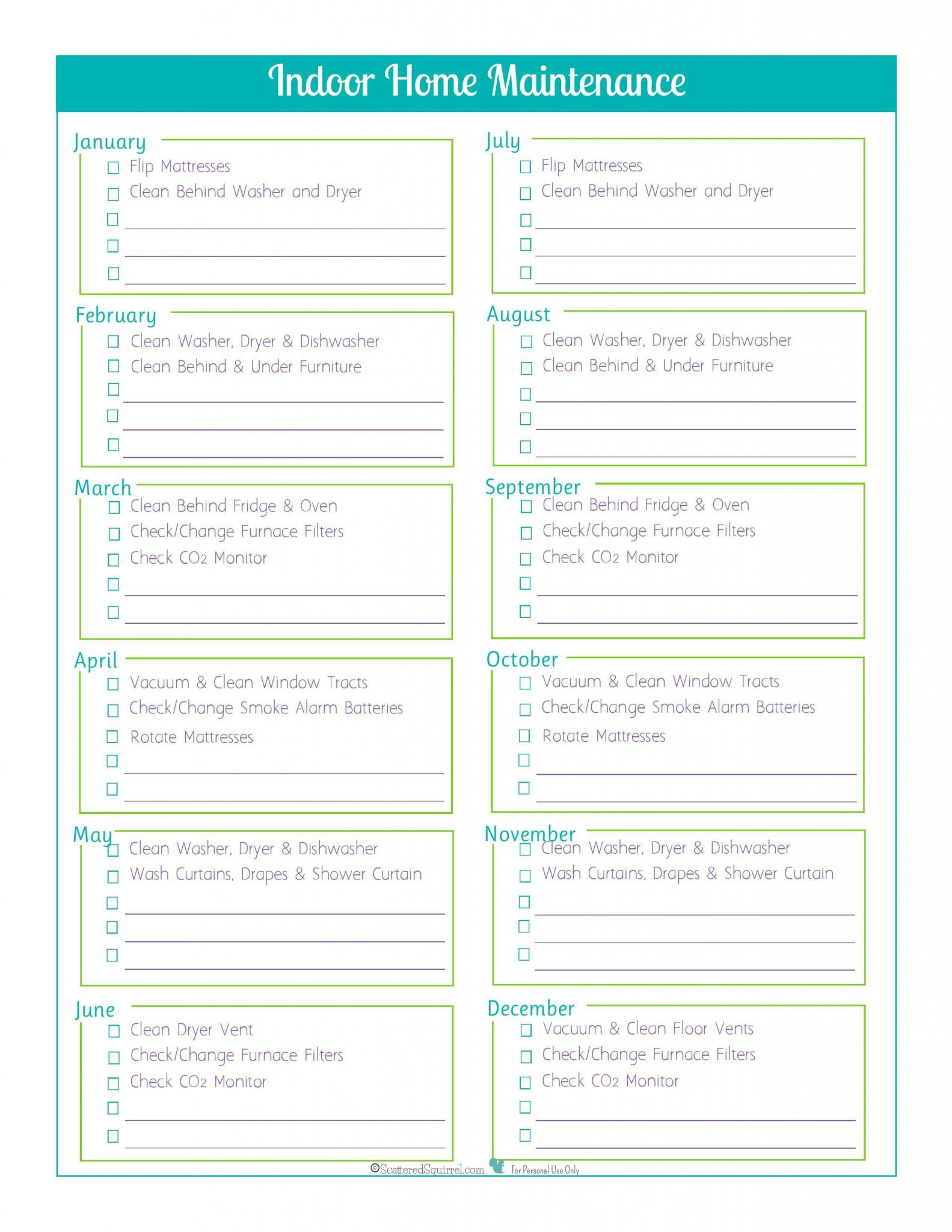

List Below The Number Of All Meals Served.

This worksheet helps day care providers track their income and expenses for tax purposes. Irs has used the federal food program allowance to determine cost of food provided to the children. When completing the separate worksheet, list as direct expenses any expenses that are attributable only to the day care part of your. It collects crucial financial data to simplify tax.

The Irs Allows Two Ways To Claim The Expenses For Your Business Use Of Auto.

Both methods require a mileage log and/or expense.