Form 8812 Worksheet - If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on schedule 8812.

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on schedule 8812. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line.

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on schedule 8812. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line.

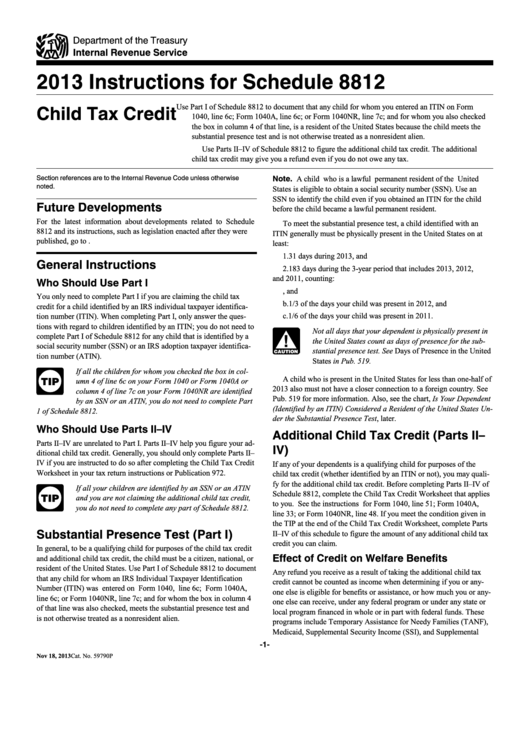

Publication 17, Your Federal Tax; Part 6 Figuring Your Taxes

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which.

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Some of the most important tax credits are child and dependent tax credits, which.

Form 8812 2023 Printable Forms Free Online

Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on schedule 8812. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household,.

Schedule 8812 Worksheet 2023

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on schedule 8812. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure.

Top 8 Form 8812 Templates free to download in PDF format

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Some of the most important tax credits are child and dependent tax credits, which.

Schedule 8812 Form 2021 Line 5 Worksheet

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which.

Download Instructions for IRS Form 1040 Schedule 8812 Credits for

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Some of the most important tax credits are child and dependent tax credits, which.

Schedule 8812 Line 5 Worksheet 2021 Printable Word Searches

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Some of the most important tax credits are child and dependent tax credits, which.

Irs Form 8812 Line 5 Worksheet

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. Some of the most important tax credits are child and dependent tax credits, which.

Schedule 8812 Line 5 Worksheet 2021

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line. Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on schedule 8812. Qualifying families with incomes less than $75,000 for single, $112,500 for head of household,.

Some Of The Most Important Tax Credits Are Child And Dependent Tax Credits, Which Eligible Taxpayers Calculate On Schedule 8812.

Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line.