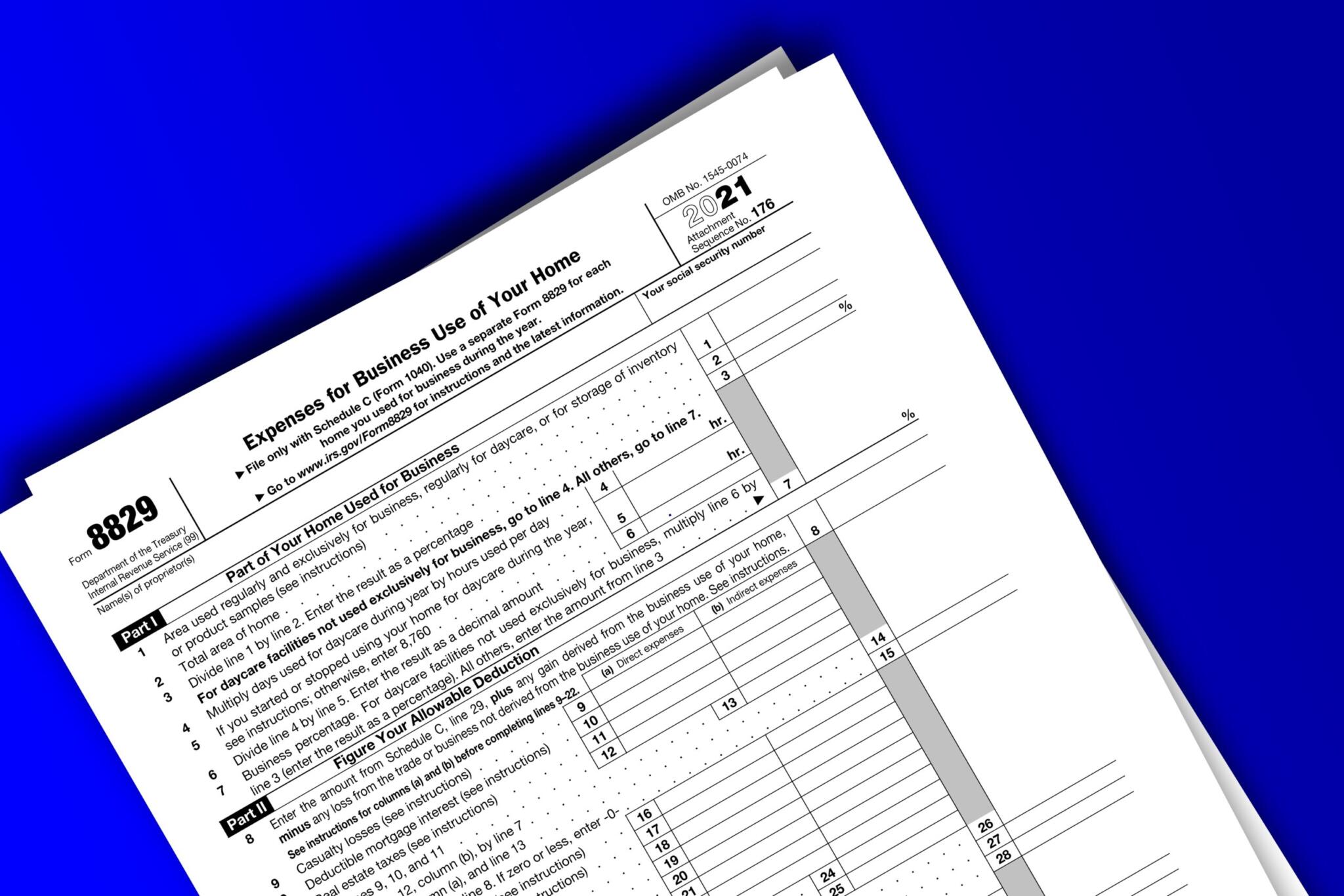

Form 8829 Line 11 Worksheet - A level 11 user provides the. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Information about form 8829, expenses for business use of your home, including recent updates, related forms and.

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. A level 11 user provides the. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software.

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. A level 11 user provides the. Information about form 8829, expenses for business use of your home, including recent updates, related forms and.

Form 8829 Line 11 Worksheet

Information about form 8829, expenses for business use of your home, including recent updates, related forms and. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of..

Form 8829 Line 11 Worksheet Instructions

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. A level 11 user provides the. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040).

IRS Form 8829 Unlocking Tax Benefits for HomeBased Businesses

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Information about form 8829, expenses for business use of your home, including recent updates, related forms and..

Form 8829 Line 11 Worksheet Instructions

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Use form 8829 to figure the allowable expenses for business use of your home on schedule c.

Form 8829 Asset Entry Worksheet

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. A level 11 user provides the. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. Use form 8829 to figure the allowable expenses for business use of.

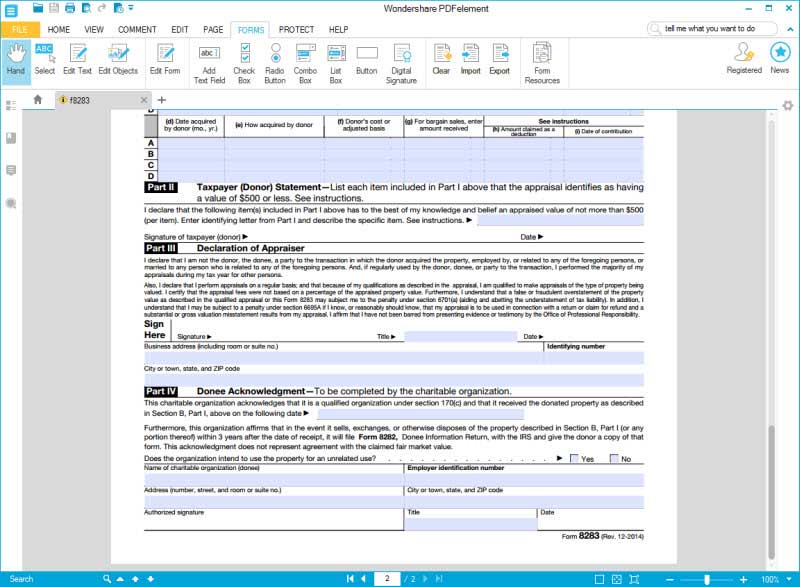

Fillable IRS Form 8829 2018 2019 Online PDF Template

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form.

Form 8829 Line 11 Worksheet

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of..

IRS Form 8829 Instructions Figuring Home Business Expenses

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. A level 11 user provides the. Use form 8829 to figure the allowable expenses for business use.

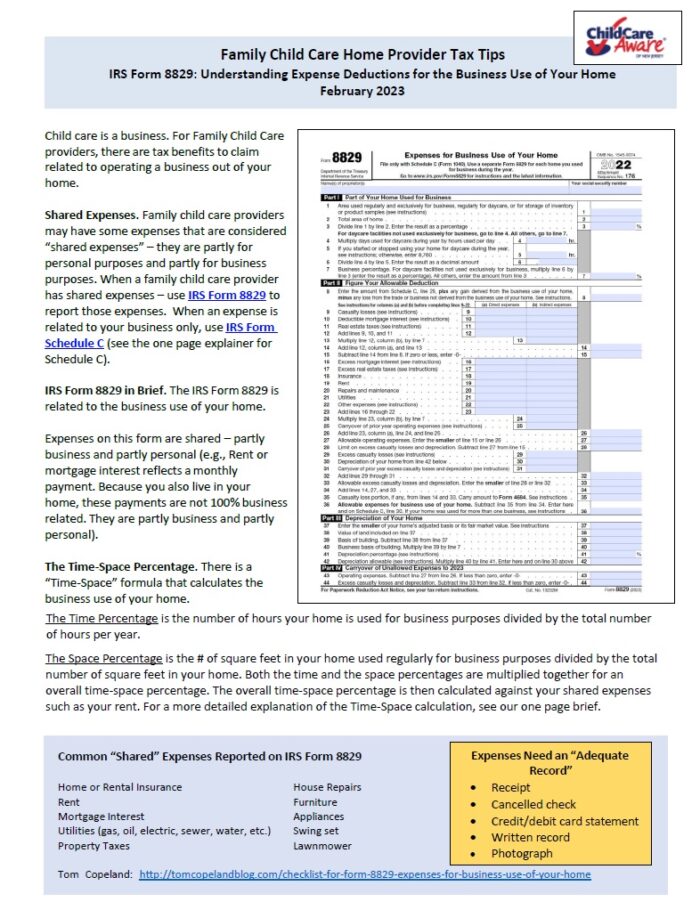

Child Care Resources IRS Form 8829 Explainer Feb 2023

A level 11 user provides the. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Information about form 8829, expenses for business use of your home,.

Form 8829 Simplified Method Worksheet Printable Computer Tools

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. A level 11 user provides the. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040).

A Level 11 User Provides The.

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax software. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of. Information about form 8829, expenses for business use of your home, including recent updates, related forms and. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2025 of.