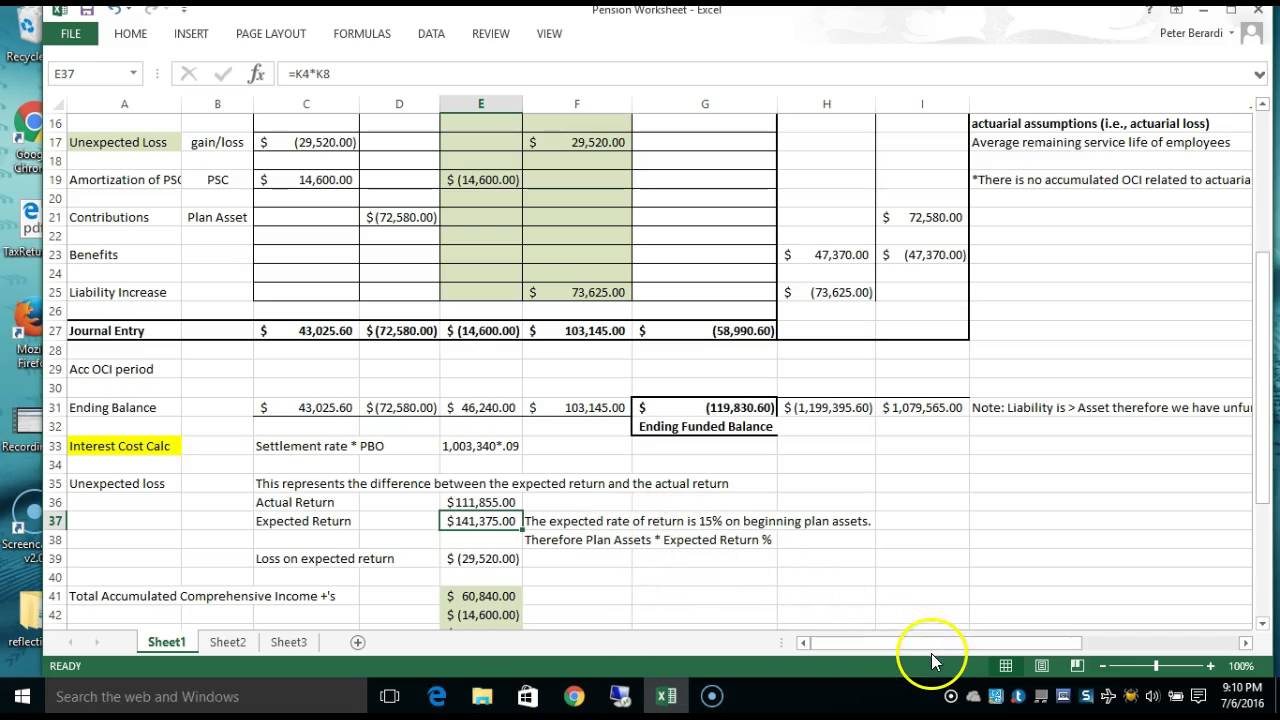

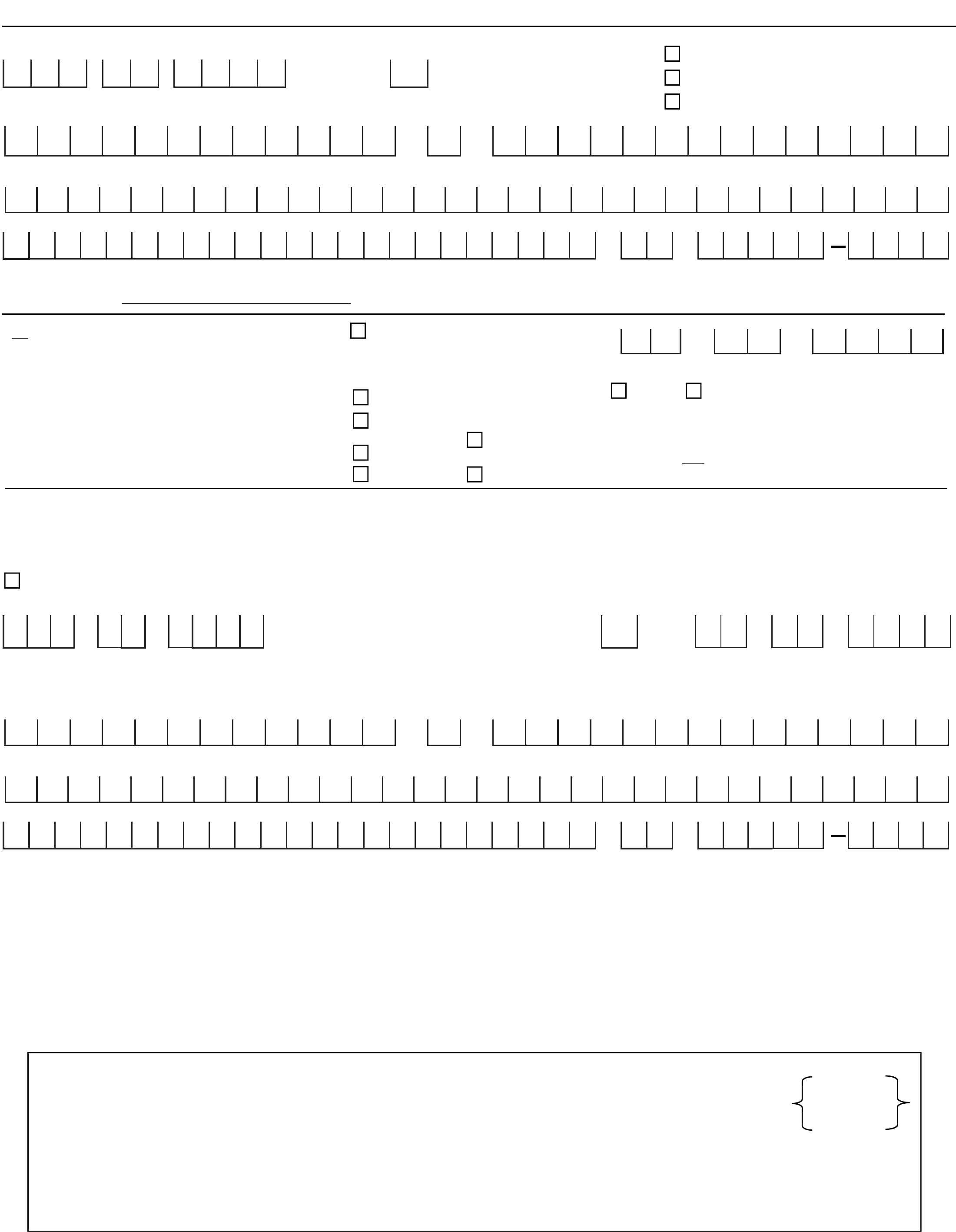

Maryland Pension Exclusion Worksheet - The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. When both you and your spouse qualify for the pension. Pension exclusion computation worksheet (13a) specific instructions note:

When both you and your spouse qualify for the pension. Pension exclusion computation worksheet (13a) specific instructions note: The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension.

The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. Pension exclusion computation worksheet (13a) specific instructions note: When both you and your spouse qualify for the pension. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans.

Maryland Pension Exclusion 2024

Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans. The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. Pension exclusion.

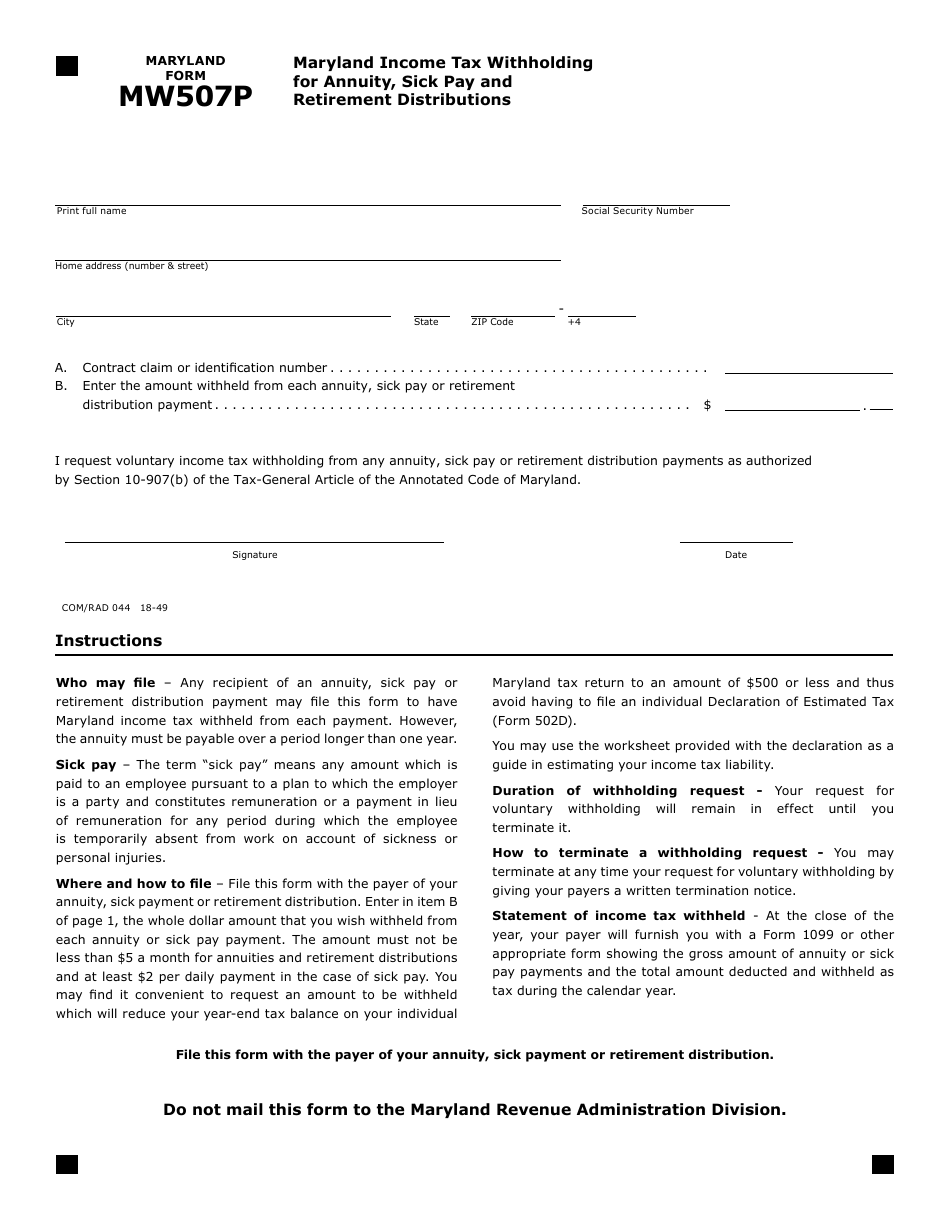

Maryland Pension Exclusion Worksheet

The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. Pension exclusion computation worksheet (13a) specific instructions note: Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans. If you are 65 or older on the last day of.

Maryland Pension Exclusion Worksheet Printable And Enjoyable Learning

The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. When both you and your spouse qualify for the pension. Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans. If you are 65 or older or totally disabled.

Maryland Pension Exclusion Worksheet 2023

If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. If you are 65 or older or totally disabled (or your spouse is totally disabled), you.

Maryland Pension Exclusion Worksheets 2021

When both you and your spouse qualify for the pension. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. If you are 65 or older on the last day of.

Maryland Pension Exclusion Worksheet 13a

If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. Explore the maryland pension exclusion, covering eligibility, tax implications, and considerations for various retirement plans. When both you and your spouse qualify for the pension. If you are 65 or older or totally.

Maryland Pension Exclusion 2024 Pdf

The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. When both you and your spouse qualify for the pension. Pension exclusion computation worksheet (13a) specific instructions note: If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and.

Maryland Pension Exclusion Worksheet 13a

The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. When both you and your spouse qualify for the pension. The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. If you are 65 or older or.

Maryland Pension Exclusion Worksheet

If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. If you are 65 or older or.

Maryland Pension Exclusion Worksheet 2023

Pension exclusion computation worksheet (13a) specific instructions note: When both you and your spouse qualify for the pension. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your.

If You Are 65 Or Older On The Last Day Of The Calendar Year, You Are Totally Disabled, Or Your Spouse Is Totally Disabled, And You Have.

If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. The maximum allowable pension exclusion of $36,200 per taxpayer on your maryland return includes your social security. The maryland tax booklet is quite clear that as long as your pension is included in your federal return it can be used as a pension. When both you and your spouse qualify for the pension.

Explore The Maryland Pension Exclusion, Covering Eligibility, Tax Implications, And Considerations For Various Retirement Plans.

Pension exclusion computation worksheet (13a) specific instructions note: