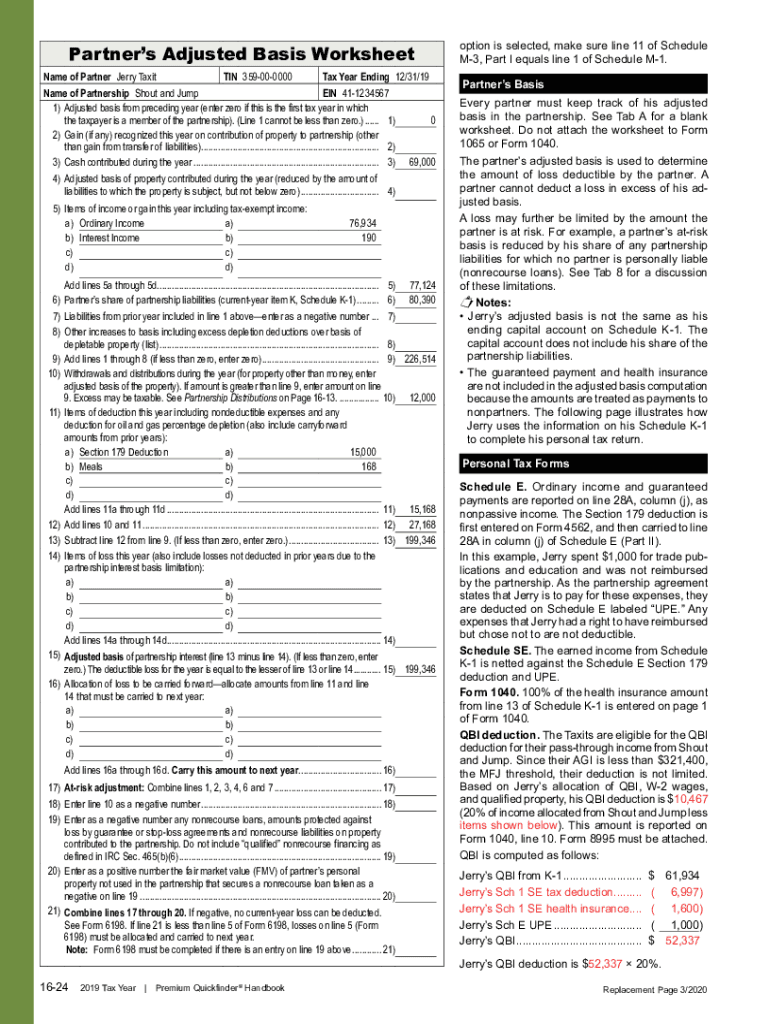

Partner S Basis Worksheet - To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. To help you track basis,. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details.

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To help you track basis,. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details.

To help you track basis,. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

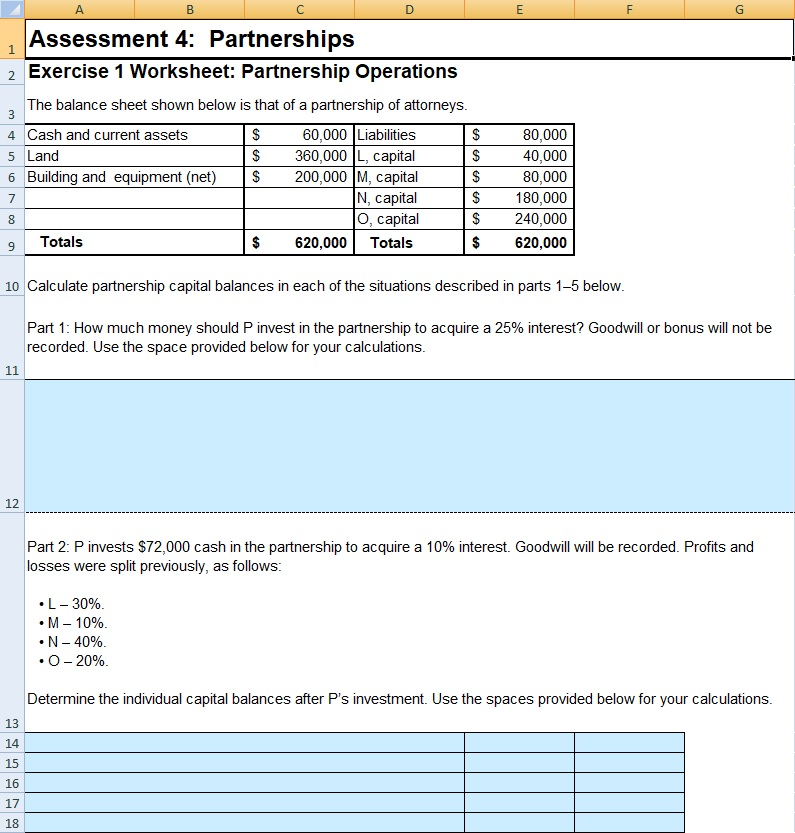

Irs Partnership Basis Calculation Worksheet

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. To help you track basis,. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. The adjusted partnership basis will be used to figure your gain or loss on the.

Partnership Tax Basis Calculation

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. To help you track basis,. The worksheet for adjusting the basis of a partner’s interest in the partnership.

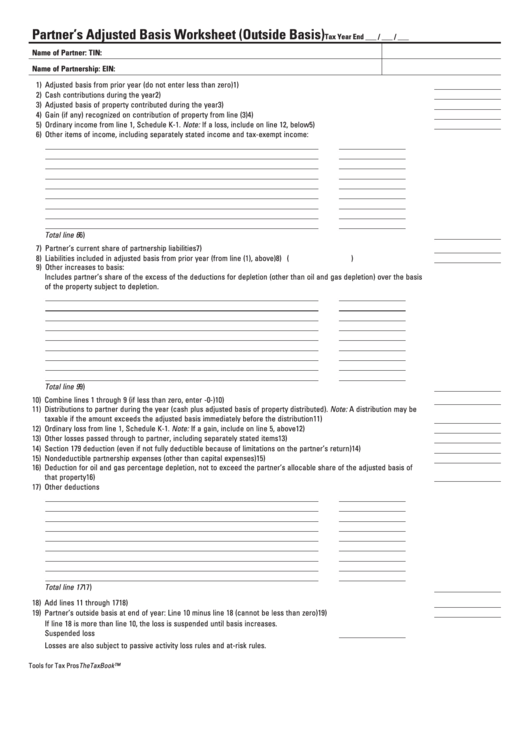

Partner's Outside Basis Worksheets

To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. To help you track basis,. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain.

Partner's Basis Worksheets

To help you track basis,. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. To assist the partners in determining their basis in the partnership, a worksheet for adjusting.

Outside Basis In A Partnership

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. To help you track basis,. Use the basis wks screen to calculate a partner’s new basis.

Partner's Outside Basis Worksheets

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s.

Partnership Basis Calculation Worksheet Printable Calendars AT A GLANCE

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. To help you track basis,. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases.

Partnership Adjusted Basis Worksheet Fillable

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of.

Quiz & Worksheet Federal Tax Implications of Basis of Partners' Interest & Partnership s Basis

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. To help you track basis,. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. To assist the partners in determining their basis in the partnership, a worksheet for adjusting.

Partnership Basis Calculation Worksheet Printable And Enjoyable Learning

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are.

To Assist The Partners In Determining Their Basis In The Partnership, A Worksheet For Adjusting The Basis Of A Partner’s Interest In The.

To help you track basis,. The worksheet for adjusting the basis of a partner’s interest in the partnership was changed to provide more details. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.