Partnership Basis Worksheet - There may be some transactions or certain distributions that require you to. Partnership basis worksheet specific instructions. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To help you track basis,. This publication provides supplemental federal income tax information for partnerships and partners. It includes topics such as withholding. Was there a new requirement that all partners need to have a basis statement before filing their tax returns?

It includes topics such as withholding. To help you track basis,. There may be some transactions or certain distributions that require you to. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. Partnership basis worksheet specific instructions. This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

Was there a new requirement that all partners need to have a basis statement before filing their tax returns? To help you track basis,. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. Partnership basis worksheet specific instructions. There may be some transactions or certain distributions that require you to. It includes topics such as withholding. This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

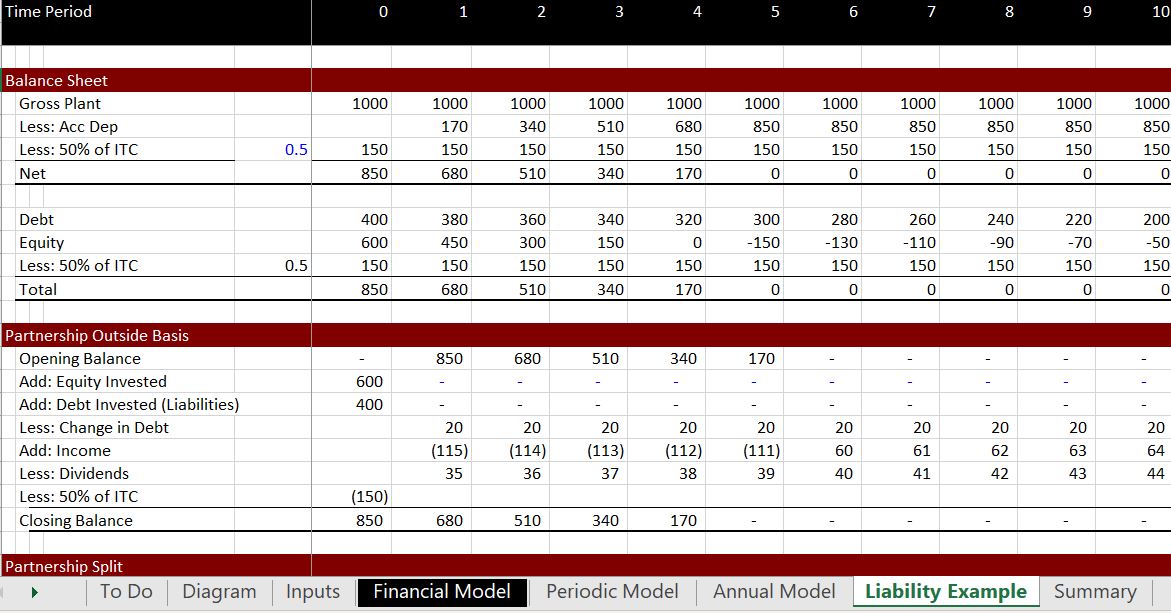

Partner Basis Worksheet Template Excel

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. There may be some transactions or certain distributions that require you to. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. It includes topics such as withholding..

Partnership Adjusted Basis Worksheet Fillable

Partnership basis worksheet specific instructions. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. It includes topics such as withholding. There may be some transactions or certain distributions that require you to. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are.

Partner Basis Worksheet Template Excel

This publication provides supplemental federal income tax information for partnerships and partners. To help you track basis,. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. There may be some transactions or certain distributions that require you to. The adjusted partnership basis will be used to figure your.

Partnership Basis Calculation Worksheet Printable And Enjoyable Learning

This publication provides supplemental federal income tax information for partnerships and partners. It includes topics such as withholding. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Partnership basis worksheet specific instructions. There may be some transactions or certain distributions that require you to.

Using the information below, complete the Excel

It includes topics such as withholding. To help you track basis,. This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. There may be some transactions or certain distributions that require you to.

Partnership Basis Worksheet Excel

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. There may be some transactions or certain distributions that require you to. This publication provides supplemental federal income tax information for partnerships and partners. To help you track basis,. Use the basis wks screen to calculate a partner’s new.

Partnership Adjusted Basis Worksheet

Was there a new requirement that all partners need to have a basis statement before filing their tax returns? Partnership basis worksheet specific instructions. There may be some transactions or certain distributions that require you to. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership.

Partnership Basis Worksheets

Partnership basis worksheet specific instructions. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. There may be some transactions or certain distributions that require you to. This publication provides supplemental federal income tax information for partnerships and partners. It includes topics such as withholding.

Free Partnership Worksheet Free to Print, Save & Download

There may be some transactions or certain distributions that require you to. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. This publication provides supplemental federal income tax information.

Partnership Adjusted Basis Worksheet Fillable

This publication provides supplemental federal income tax information for partnerships and partners. To help you track basis,. There may be some transactions or certain distributions that require you to. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. Was there a new requirement that all partners need to.

This Publication Provides Supplemental Federal Income Tax Information For Partnerships And Partners.

It includes topics such as withholding. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? To help you track basis,. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

There May Be Some Transactions Or Certain Distributions That Require You To.

Partnership basis worksheet specific instructions. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the.