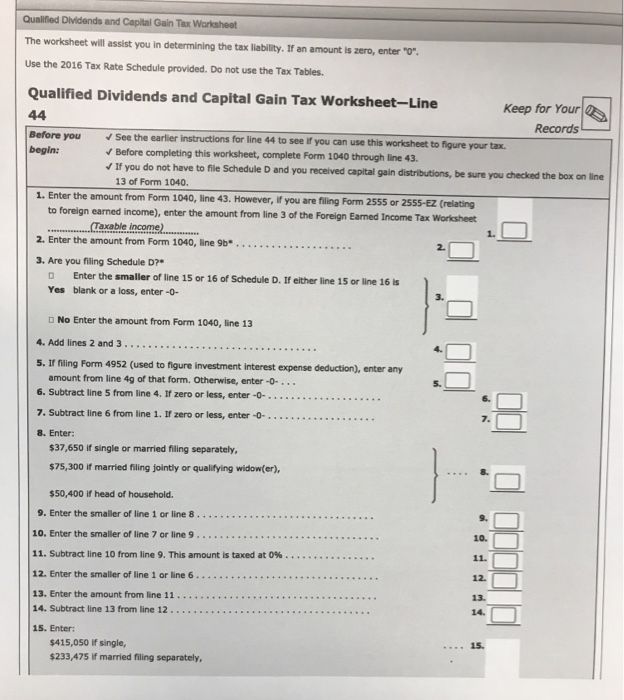

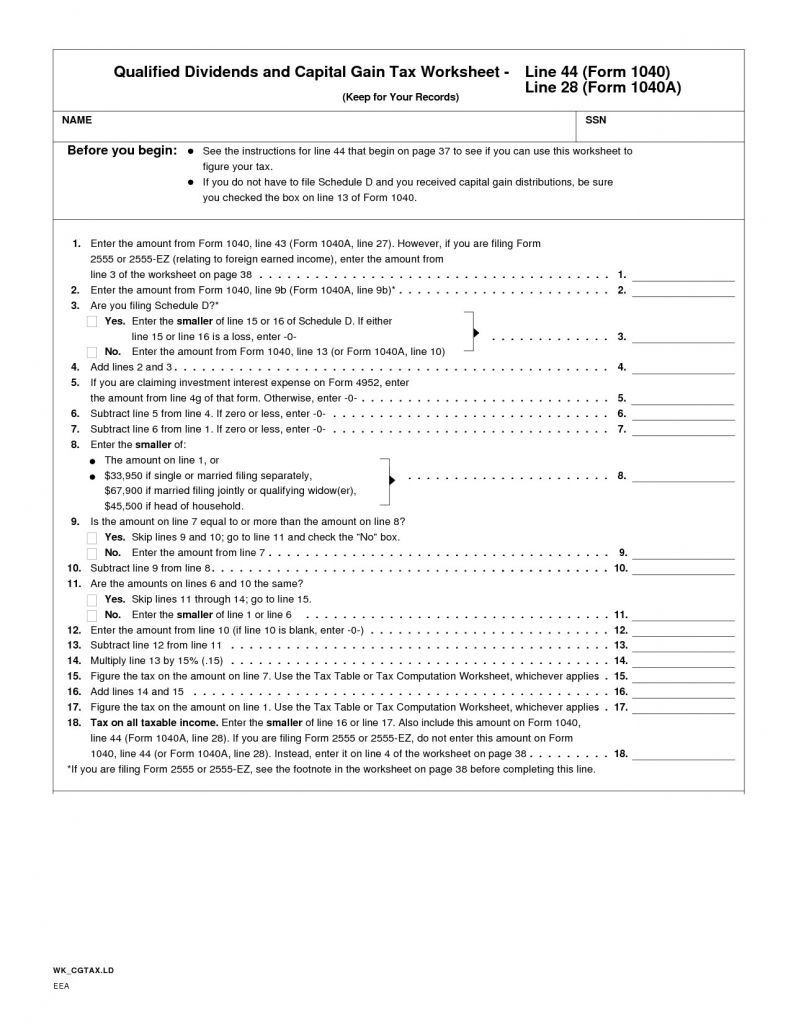

Qualified Dividends And Capital Gains Worksheet - The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment.

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment.

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form.

Qualified Dividends And Capital Gains Tax

The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

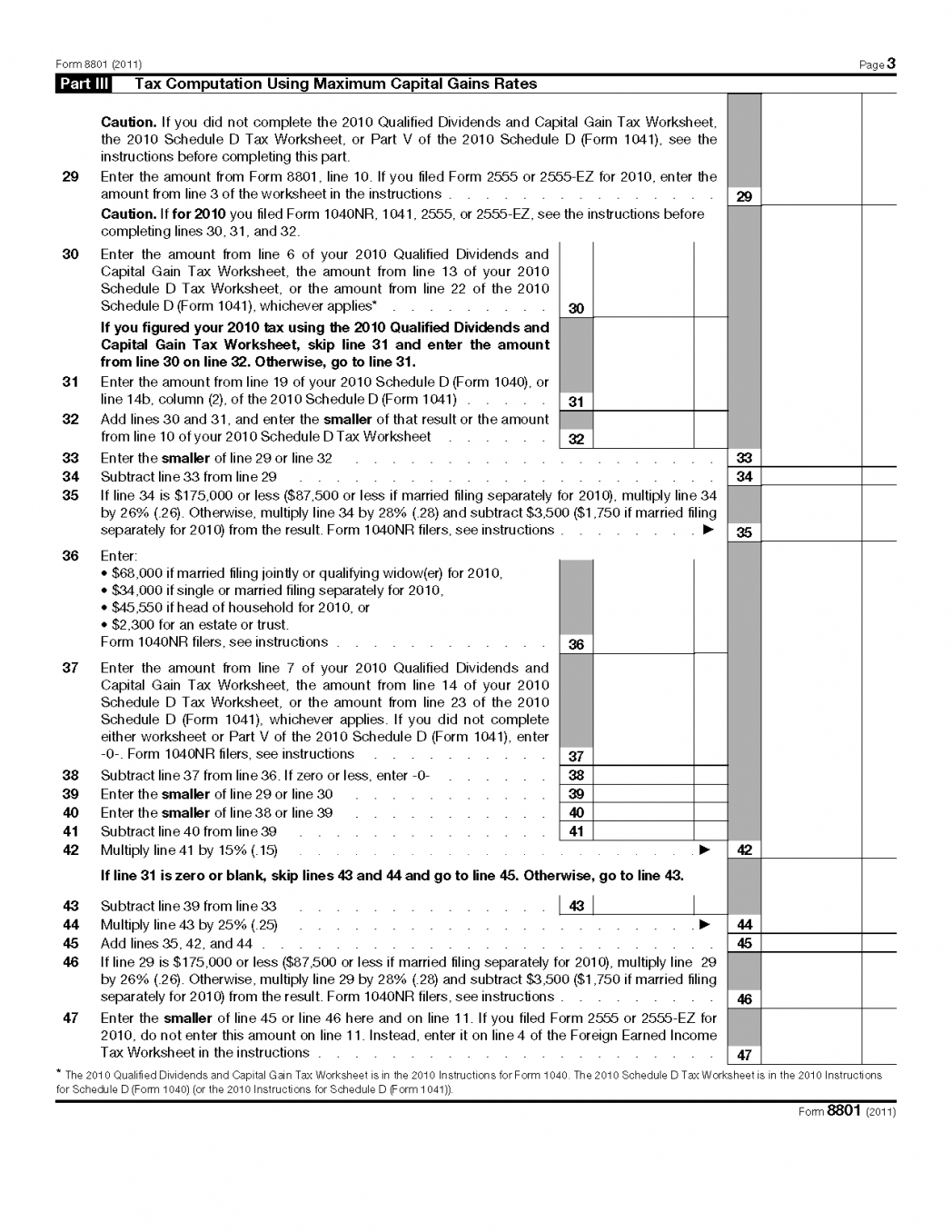

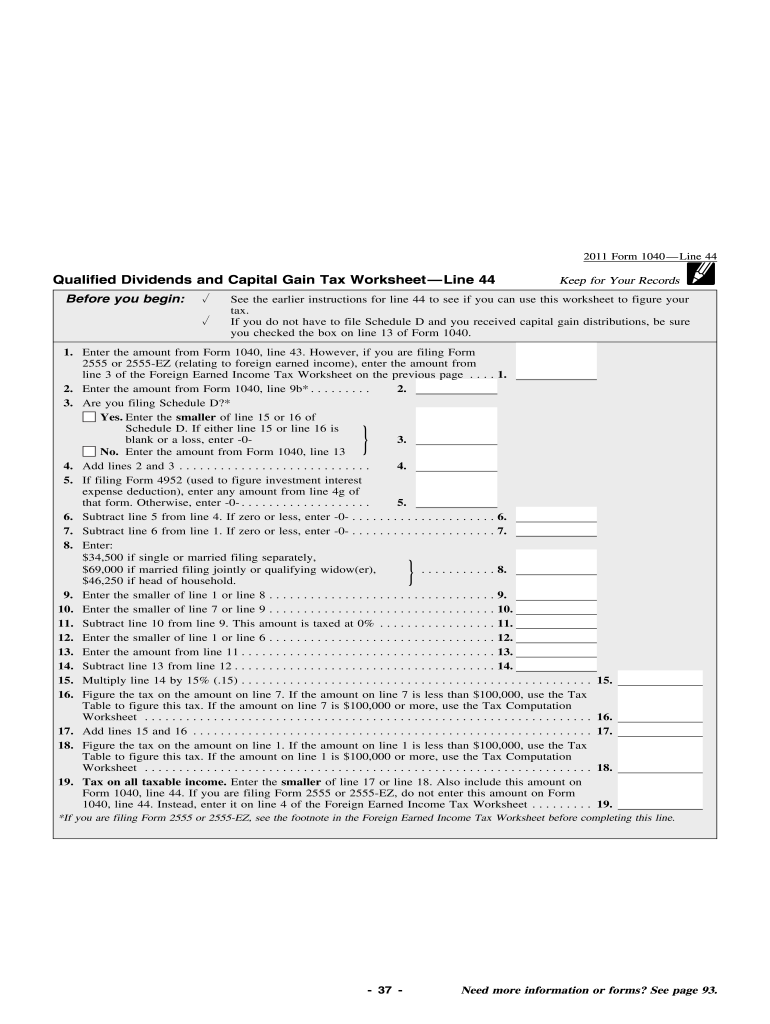

Qualified Dividends And Capital Gain Tax Worksheet Calculato

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

Qualified Dividend And Capital Gain Worksheet 2023 Qualified

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

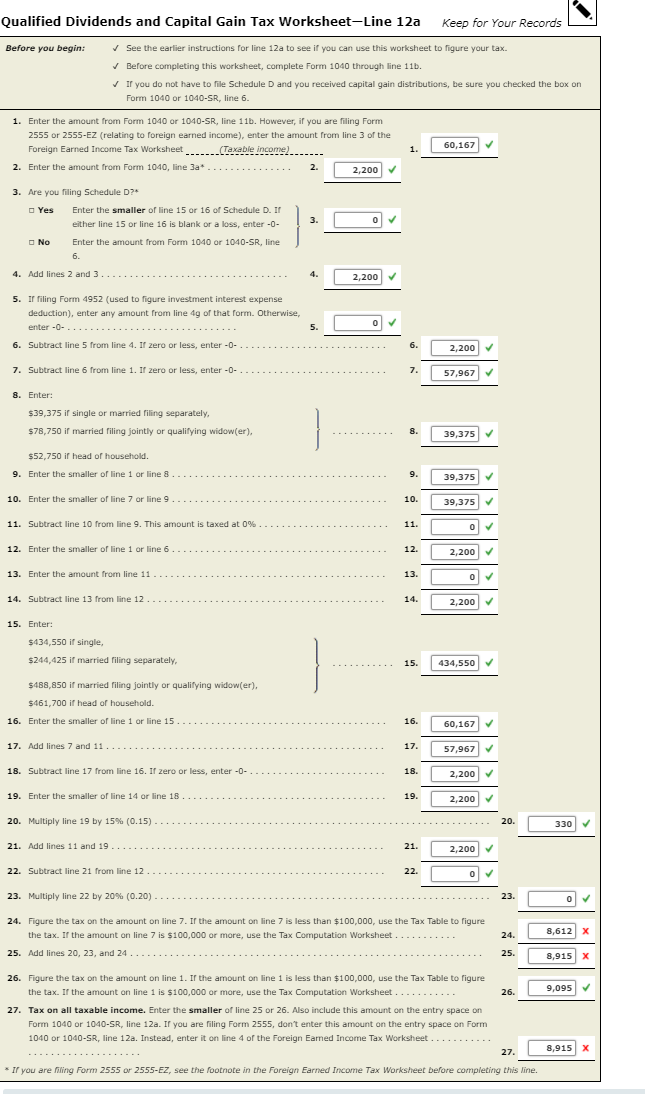

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital.

1040a Capital Gains Worksheets

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital.

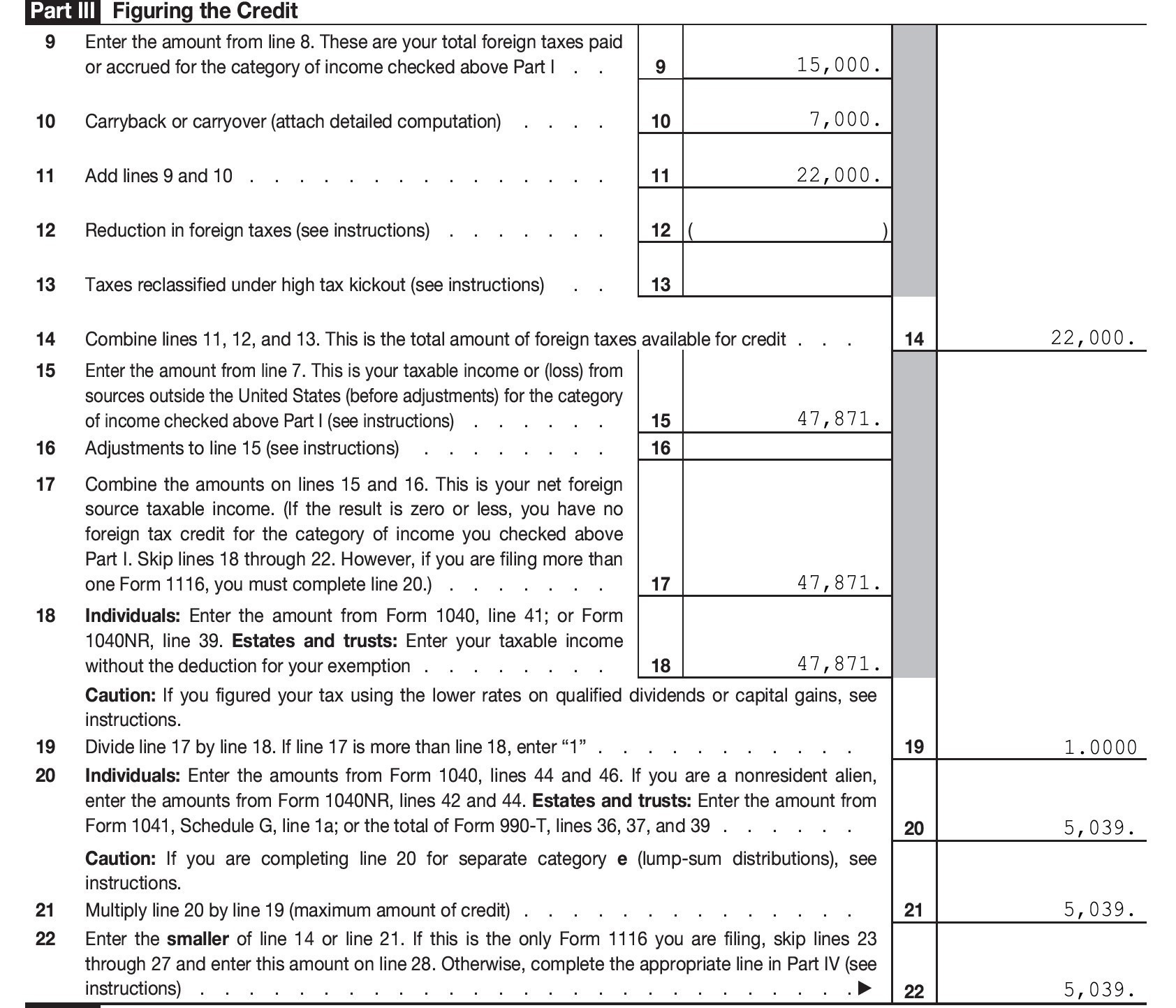

Qualified Dividends And Capital Gains Tax Worksheet Printable

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

Qualified Dividends And Capital Gain Tax Worksheet Calculato

The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

2023 Qualified Dividends And Capital Gain Tax Worksheet Gain

The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16.

Capital Gains Tax Worksheets 2020

The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. The most important lesson to learn from this worksheet.

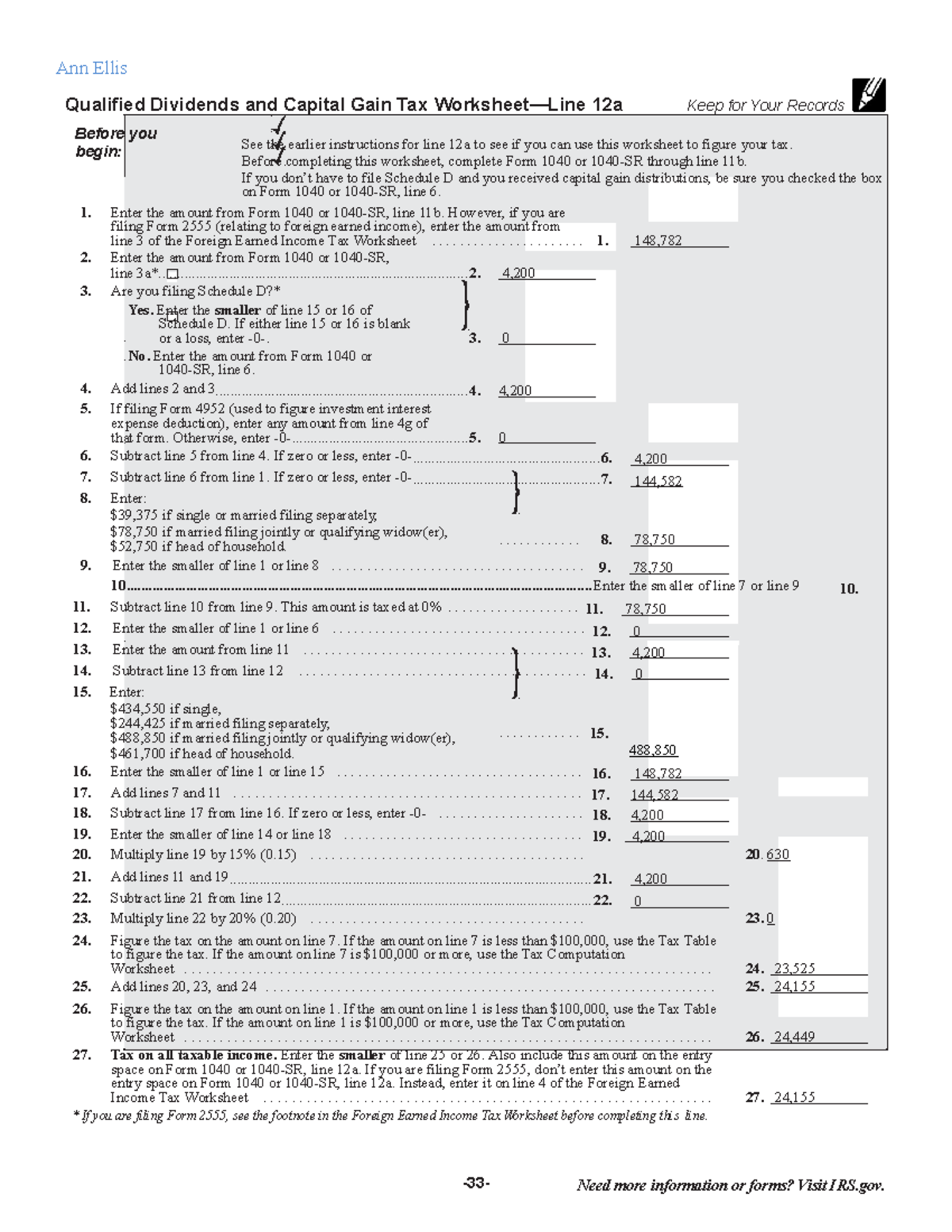

Qualified Dividends and Capital Gains Worksheet Ann Ellis Qualified

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. The most important lesson to learn from this worksheet is that qualified dividends and capital gains stack on top. The qualified dividends and capital gain worksheet is vital.

The Most Important Lesson To Learn From This Worksheet Is That Qualified Dividends And Capital Gains Stack On Top.

The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form.