Recent Tax Proposals - Republicans are looking to generate savings with new work requirements. Here's who would benefit from the change. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. This new limitation is effective for taxable years beginning after december 31, 2025. But democrats warn that millions of americans will lose coverage. Since he took office, trump has proposed the largest tax cut in american history. The “one big, beautiful bill” promises permanent tax cuts —.

This new limitation is effective for taxable years beginning after december 31, 2025. Republicans are looking to generate savings with new work requirements. But democrats warn that millions of americans will lose coverage. Since he took office, trump has proposed the largest tax cut in american history. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. The “one big, beautiful bill” promises permanent tax cuts —. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Here's who would benefit from the change.

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. The “one big, beautiful bill” promises permanent tax cuts —. Since he took office, trump has proposed the largest tax cut in american history. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. But democrats warn that millions of americans will lose coverage. Republicans are looking to generate savings with new work requirements. Here's who would benefit from the change. This new limitation is effective for taxable years beginning after december 31, 2025.

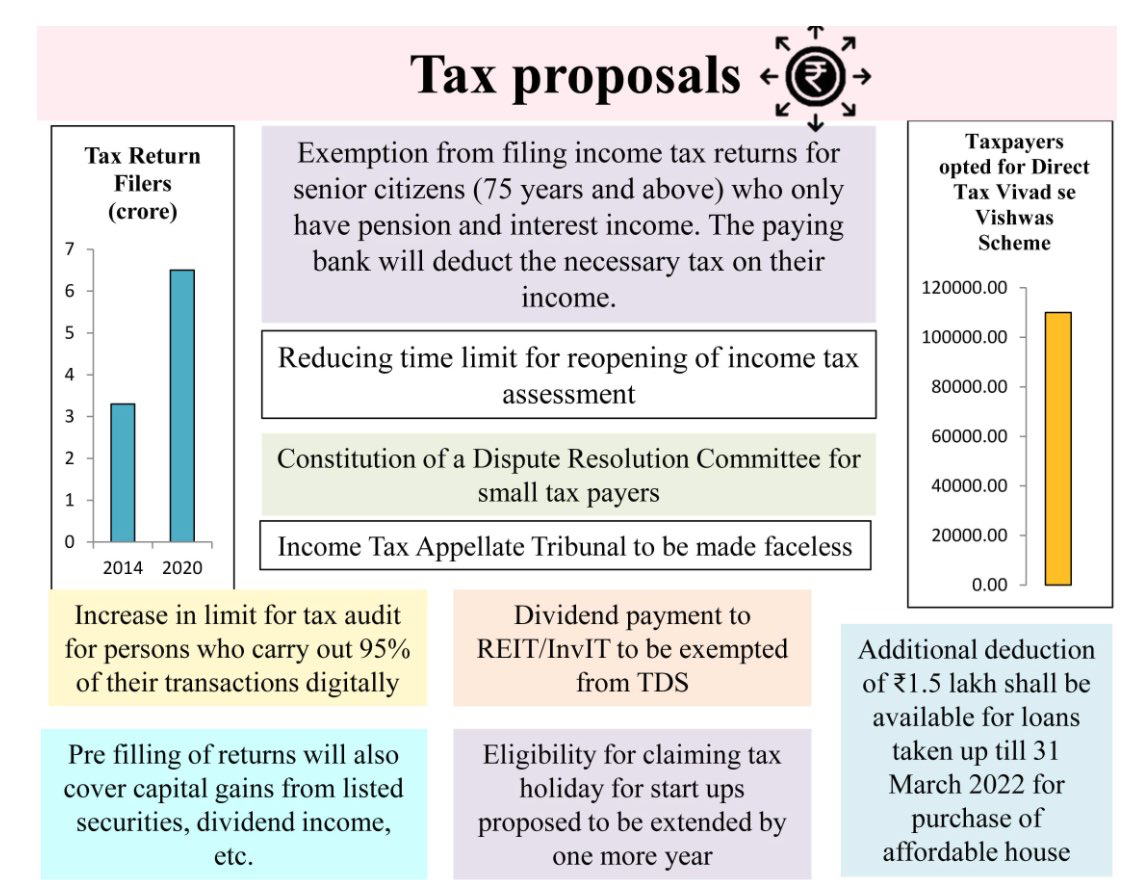

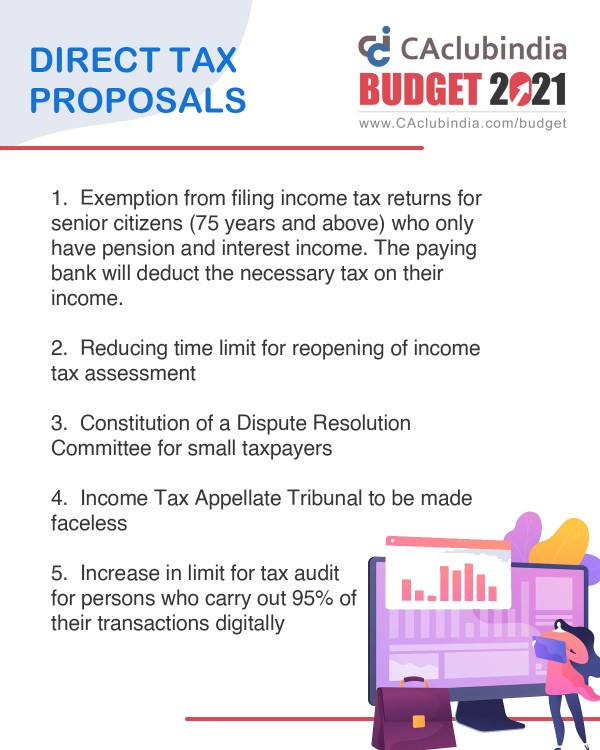

Budget 2021 Direct Tax Proposals

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. Republicans are looking to generate savings with new work requirements. This new limitation is effective for taxable years beginning after december 31, 2025. But democrats warn that millions of americans will lose coverage. Since he took office, trump has proposed the largest tax cut in american history.

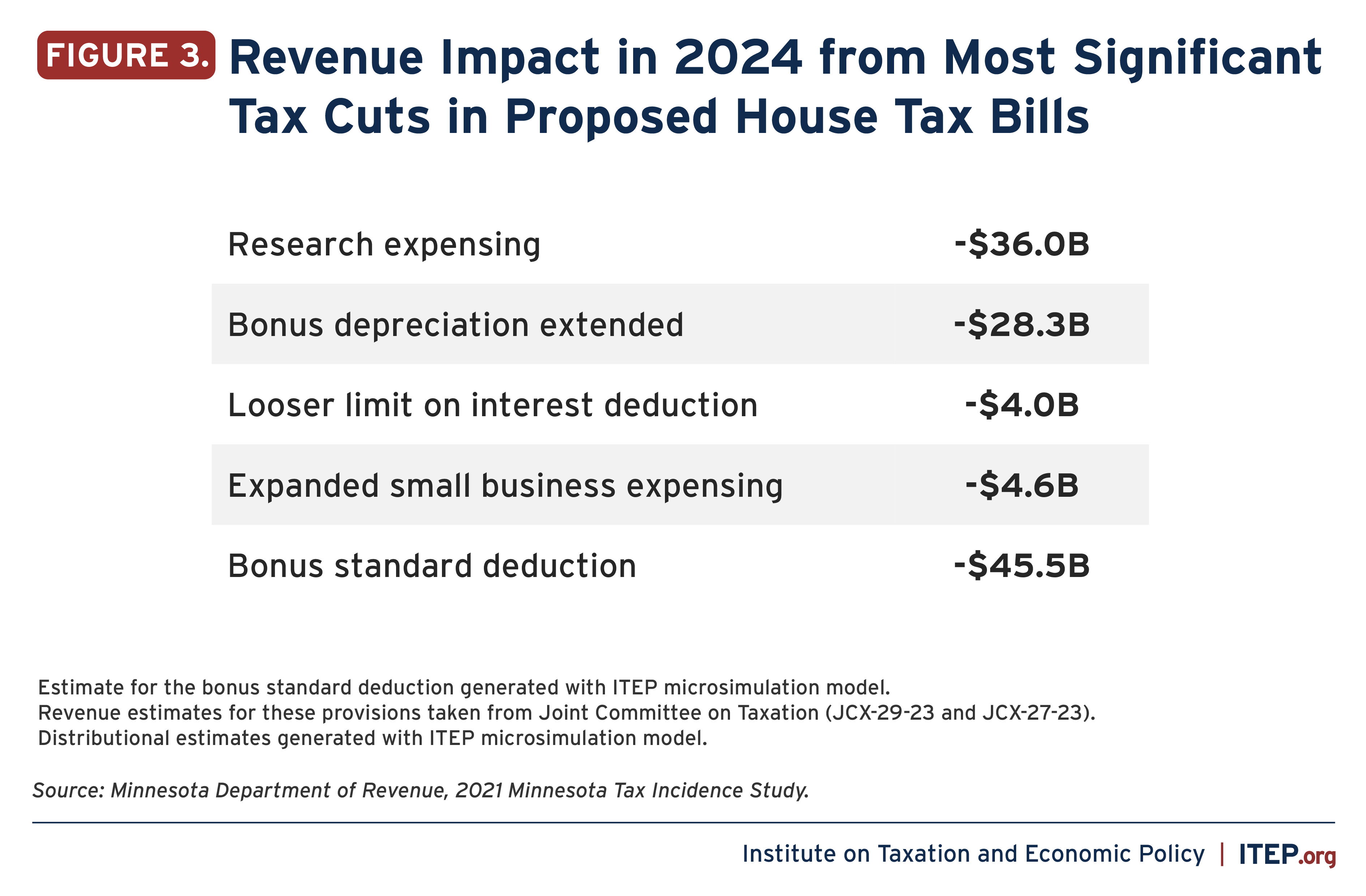

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing

Since he took office, trump has proposed the largest tax cut in american history. The “one big, beautiful bill” promises permanent tax cuts —. But democrats warn that millions of americans will lose coverage. Here's who would benefit from the change. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of.

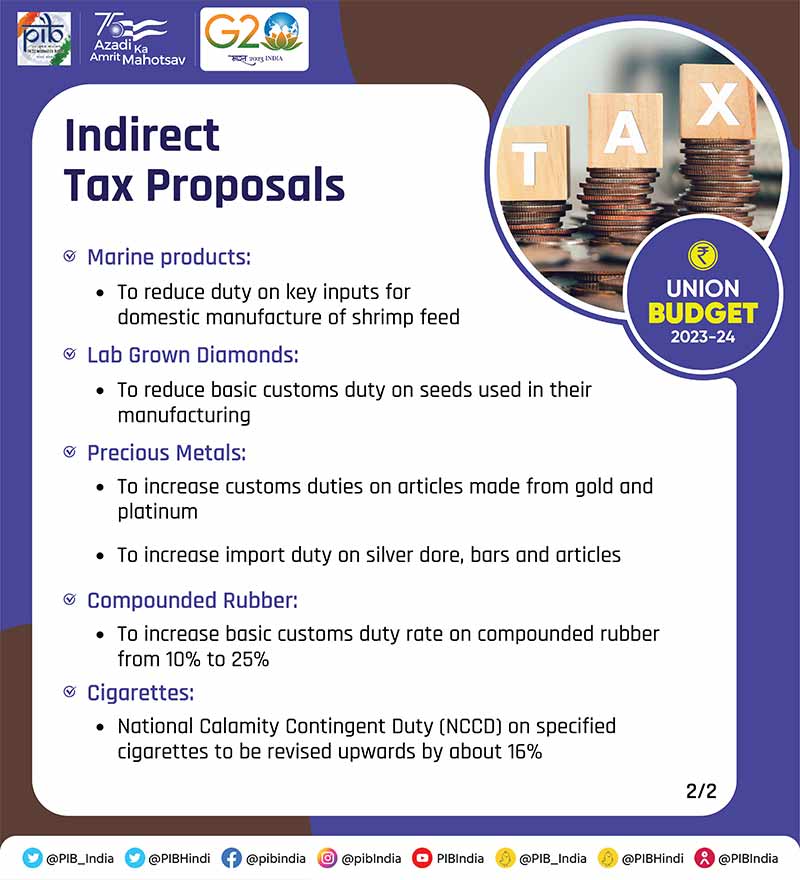

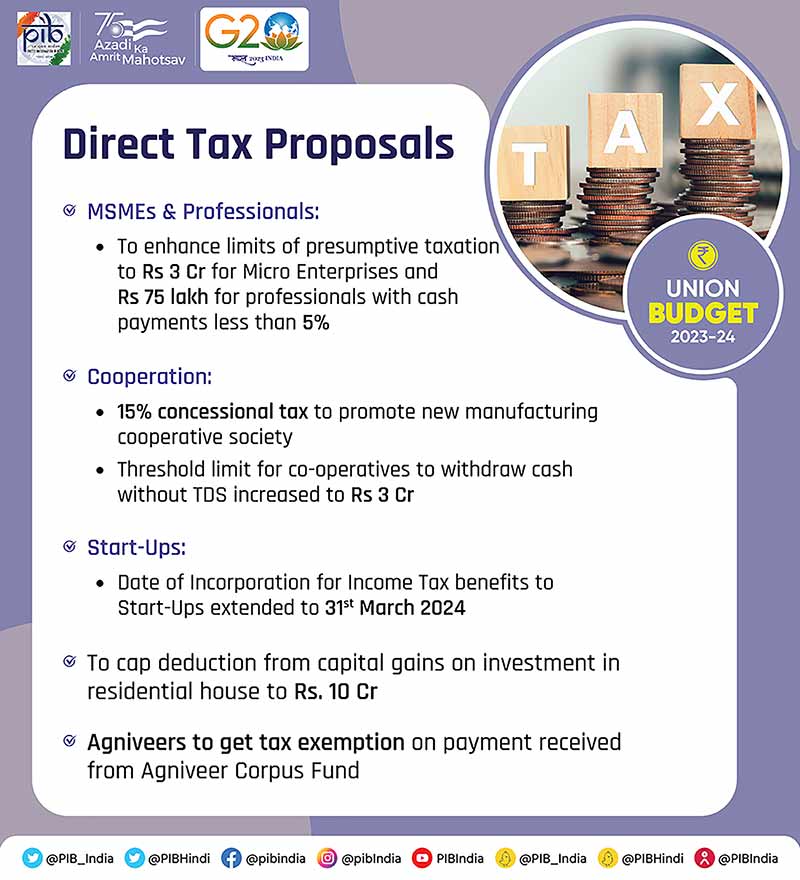

Budget 2023 in Pictures Important Facts and Numbers Explained in

The “one big, beautiful bill” promises permanent tax cuts —. Since he took office, trump has proposed the largest tax cut in american history. House republicans passed a bill to raise the 'salt' deduction cap to $40,000. Republicans are looking to generate savings with new work requirements. This new limitation is effective for taxable years beginning after december 31, 2025.

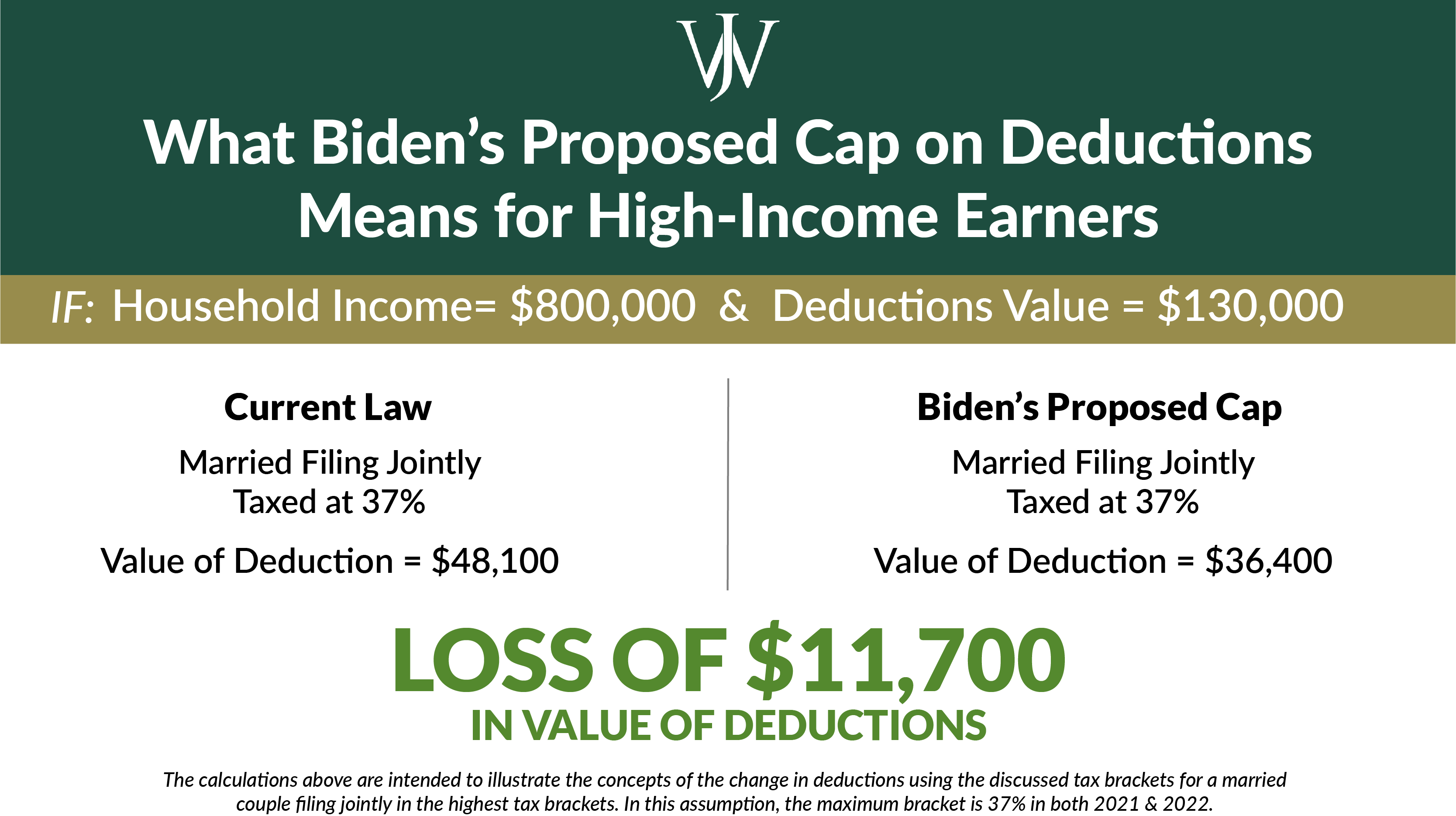

Analyzing the New Tax Proposal Plan to Rise Above®

Since he took office, trump has proposed the largest tax cut in american history. Republicans are looking to generate savings with new work requirements. The “one big, beautiful bill” promises permanent tax cuts —. Here's who would benefit from the change. House republicans passed a bill to raise the 'salt' deduction cap to $40,000.

An Overview of Recent Tax Reform Proposals

Here's who would benefit from the change. This new limitation is effective for taxable years beginning after december 31, 2025. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Since he took office, trump has proposed the largest tax cut in american history. The “one big, beautiful bill”.

Direct Tax Proposals Budget 2021

Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. But democrats warn that millions of americans will lose coverage. Republicans are looking to generate savings with new work requirements. The “one big, beautiful bill” promises permanent tax cuts —. Here's who would benefit from the change.

2021 Tax Changes Biden's Families' & Capital Gains

This new limitation is effective for taxable years beginning after december 31, 2025. Since he took office, trump has proposed the largest tax cut in american history. But democrats warn that millions of americans will lose coverage. Republicans are looking to generate savings with new work requirements. House republicans passed a bill to raise the 'salt' deduction cap to $40,000.

Breaking Down the New 2021 Federal Tax Proposals Strohmeyer Law PLLC

But democrats warn that millions of americans will lose coverage. This new limitation is effective for taxable years beginning after december 31, 2025. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. Here's who would benefit from the change. The “one big, beautiful bill” promises permanent tax cuts.

Biden's New Tax Proposals and What They Mean For You — Human Investing

Since he took office, trump has proposed the largest tax cut in american history. But democrats warn that millions of americans will lose coverage. The “one big, beautiful bill” promises permanent tax cuts —. Key proposals in the house bill would make permanent many provisions of the tcja, restore favorable tax treatment of various business. This new limitation is effective.

Budget 2023 in Pictures Important Facts and Numbers Explained in

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. But democrats warn that millions of americans will lose coverage. The “one big, beautiful bill” promises permanent tax cuts —. This new limitation is effective for taxable years beginning after december 31, 2025. Republicans are looking to generate savings with new work requirements.

Key Proposals In The House Bill Would Make Permanent Many Provisions Of The Tcja, Restore Favorable Tax Treatment Of Various Business.

The “one big, beautiful bill” promises permanent tax cuts —. Here's who would benefit from the change. Republicans are looking to generate savings with new work requirements. This new limitation is effective for taxable years beginning after december 31, 2025.

Since He Took Office, Trump Has Proposed The Largest Tax Cut In American History.

House republicans passed a bill to raise the 'salt' deduction cap to $40,000. But democrats warn that millions of americans will lose coverage.