Self Employment Deductions Worksheet - A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. I certify that i have listed all income, all. Schedule c worksheet for self employed businesses and/or independent contractors. 4.5/5 (15k)

I certify that i have listed all income, all. Schedule c worksheet for self employed businesses and/or independent contractors. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. 4.5/5 (15k)

I certify that i have listed all income, all. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Schedule c worksheet for self employed businesses and/or independent contractors. 4.5/5 (15k)

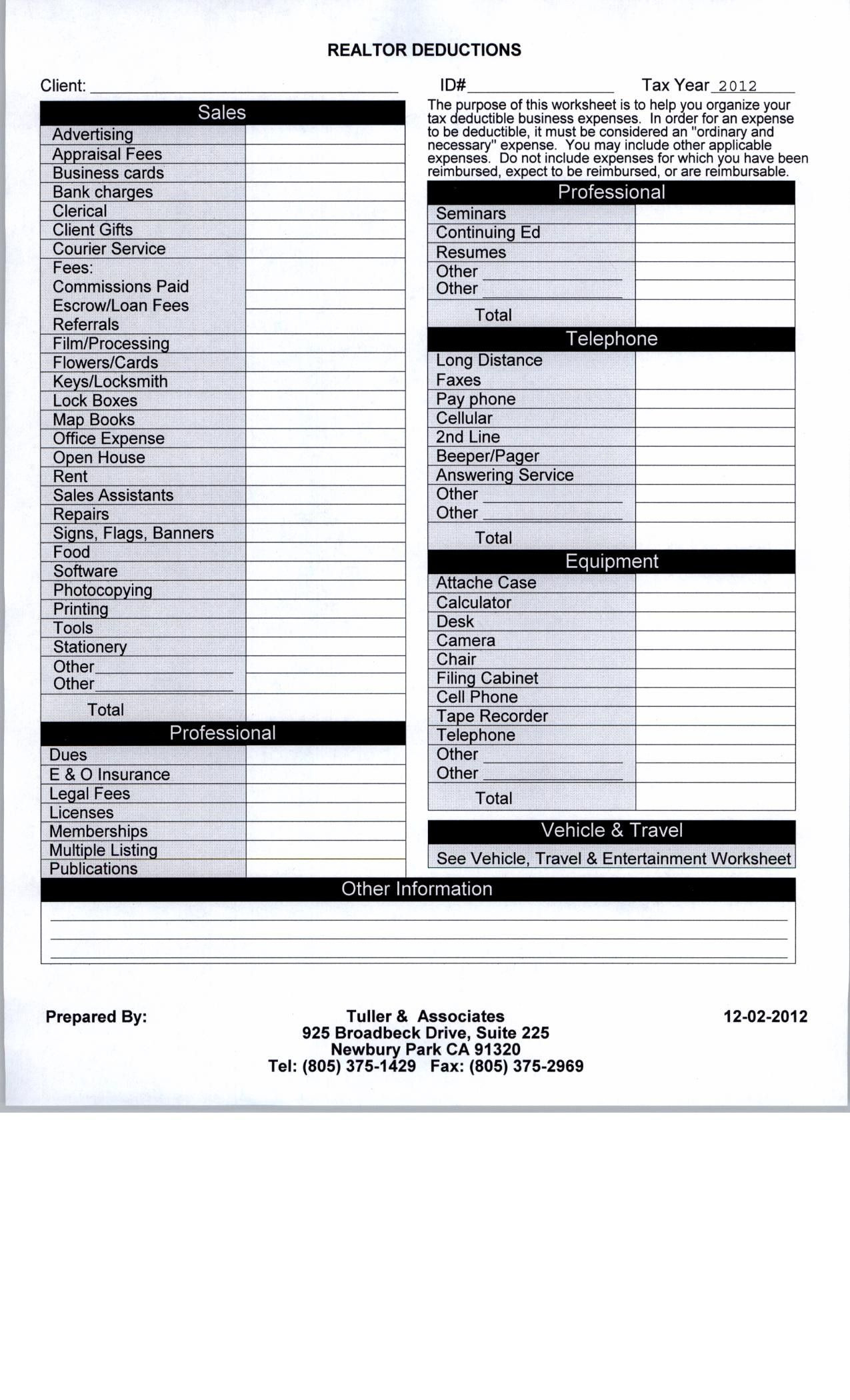

Printable Itemized Deductions Worksheet

4.5/5 (15k) Schedule c worksheet for self employed businesses and/or independent contractors. I certify that i have listed all income, all. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.

Self Employed Home Office Deduction 2024 Worksheet Sunny Ernaline

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. 4.5/5 (15k) I certify that i have listed all income, all. Schedule c worksheet for self employed businesses and/or independent contractors.

Self Employment Printable Small Business Tax Deductions Work

I certify that i have listed all income, all. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Schedule c worksheet for self employed businesses and/or independent contractors. 4.5/5 (15k)

2016 Self Employment Tax And Deduction Worksheet —

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Schedule c worksheet for self employed businesses and/or independent contractors. 4.5/5 (15k) I certify that i have listed all income, all.

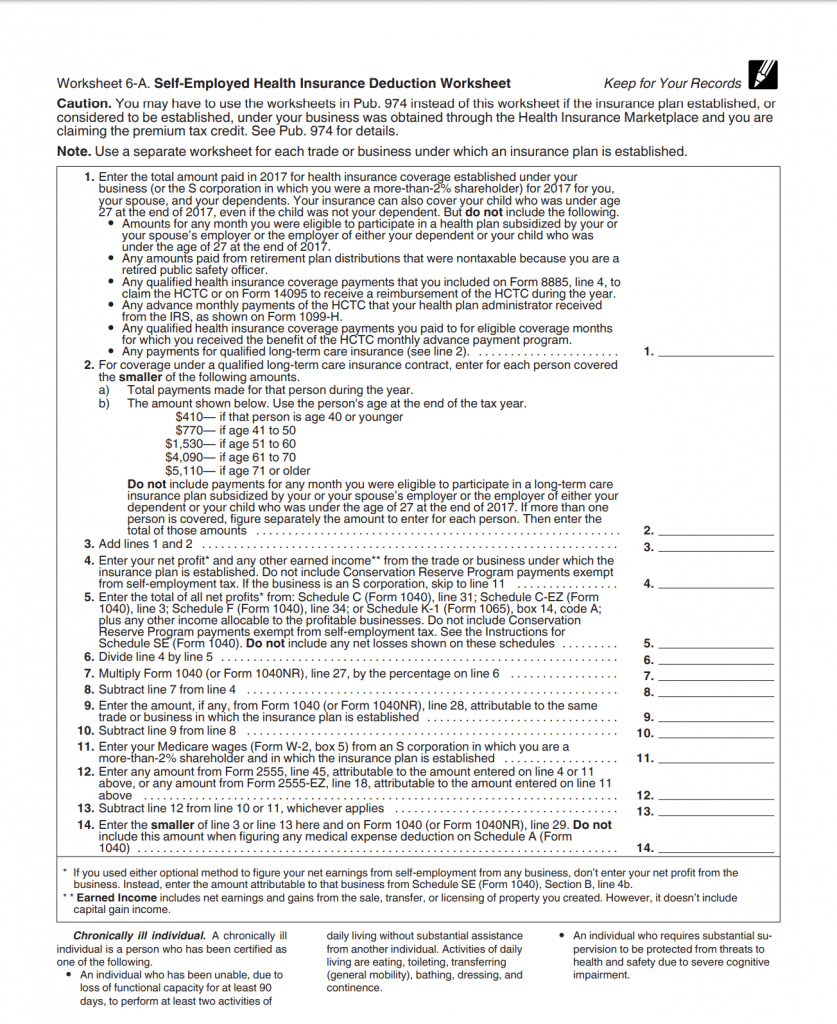

Self Employed Health Insurance Deduction Worksheet —

I certify that i have listed all income, all. Schedule c worksheet for self employed businesses and/or independent contractors. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. 4.5/5 (15k)

Tax Deduction Worksheet For Self Employed

Schedule c worksheet for self employed businesses and/or independent contractors. I certify that i have listed all income, all. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. 4.5/5 (15k)

Self Employment Printable Small Business Tax Deductions Work

4.5/5 (15k) I certify that i have listed all income, all. Schedule c worksheet for self employed businesses and/or independent contractors. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.

The Epic Cheat Sheet to Deductions for SelfEmployed Rockstars

4.5/5 (15k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Schedule c worksheet for self employed businesses and/or independent contractors. I certify that i have listed all income, all.

Self Employed Tax Deductions Worksheet Small Business Tax De

I certify that i have listed all income, all. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Schedule c worksheet for self employed businesses and/or independent contractors. 4.5/5 (15k)

Self Employment Printable Small Business Tax Deductions Work

4.5/5 (15k) Schedule c worksheet for self employed businesses and/or independent contractors. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. I certify that i have listed all income, all.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors.

I certify that i have listed all income, all. 4.5/5 (15k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.