Tax Warrant Kansas - Learn how to pay, remove your name, or bid on seized items from the tax. If any tax due to the state of. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Find out if you or your business have unresolved tax debts in kansas. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. New section 1 of the bill, now k.s.a. Find out the criteria, fees, options and.

Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Find out the criteria, fees, options and. If any tax due to the state of. Find out if you or your business have unresolved tax debts in kansas. Learn how to pay, remove your name, or bid on seized items from the tax. New section 1 of the bill, now k.s.a. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas.

Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. New section 1 of the bill, now k.s.a. Find out the criteria, fees, options and. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. Find out if you or your business have unresolved tax debts in kansas. Learn how to pay, remove your name, or bid on seized items from the tax. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. If any tax due to the state of. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a.

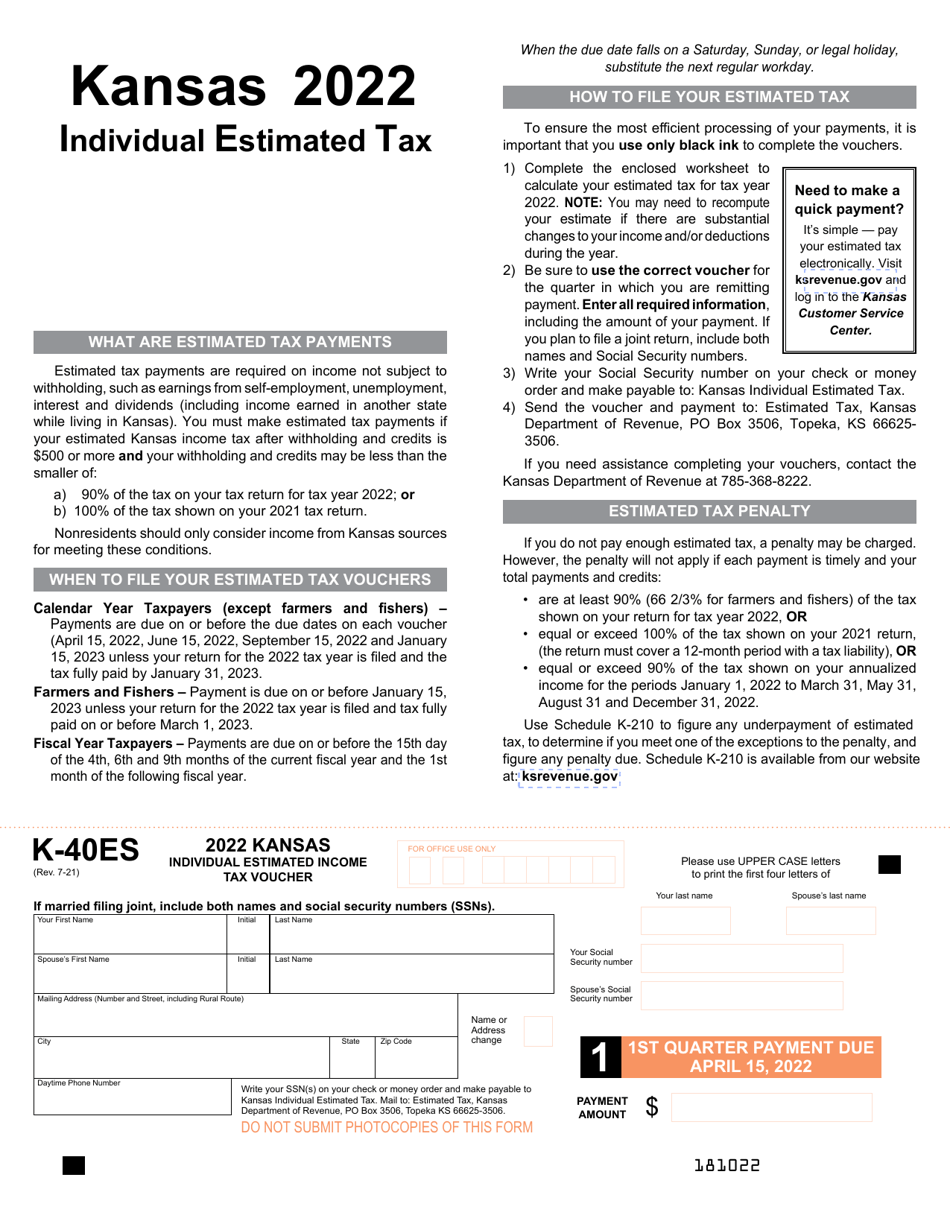

Form K40ES Download Fillable PDF or Fill Online Kansas Individual

Learn how to pay, remove your name, or bid on seized items from the tax. Find out if you or your business have unresolved tax debts in kansas. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. If any tax due to the state of. (a) whenever a taxpayer liable.

How To Check For Warrants In Wichita, Kansas? YouTube

If any tax due to the state of. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Find out if you or your business have unresolved tax debts in kansas. Find out the criteria, fees,.

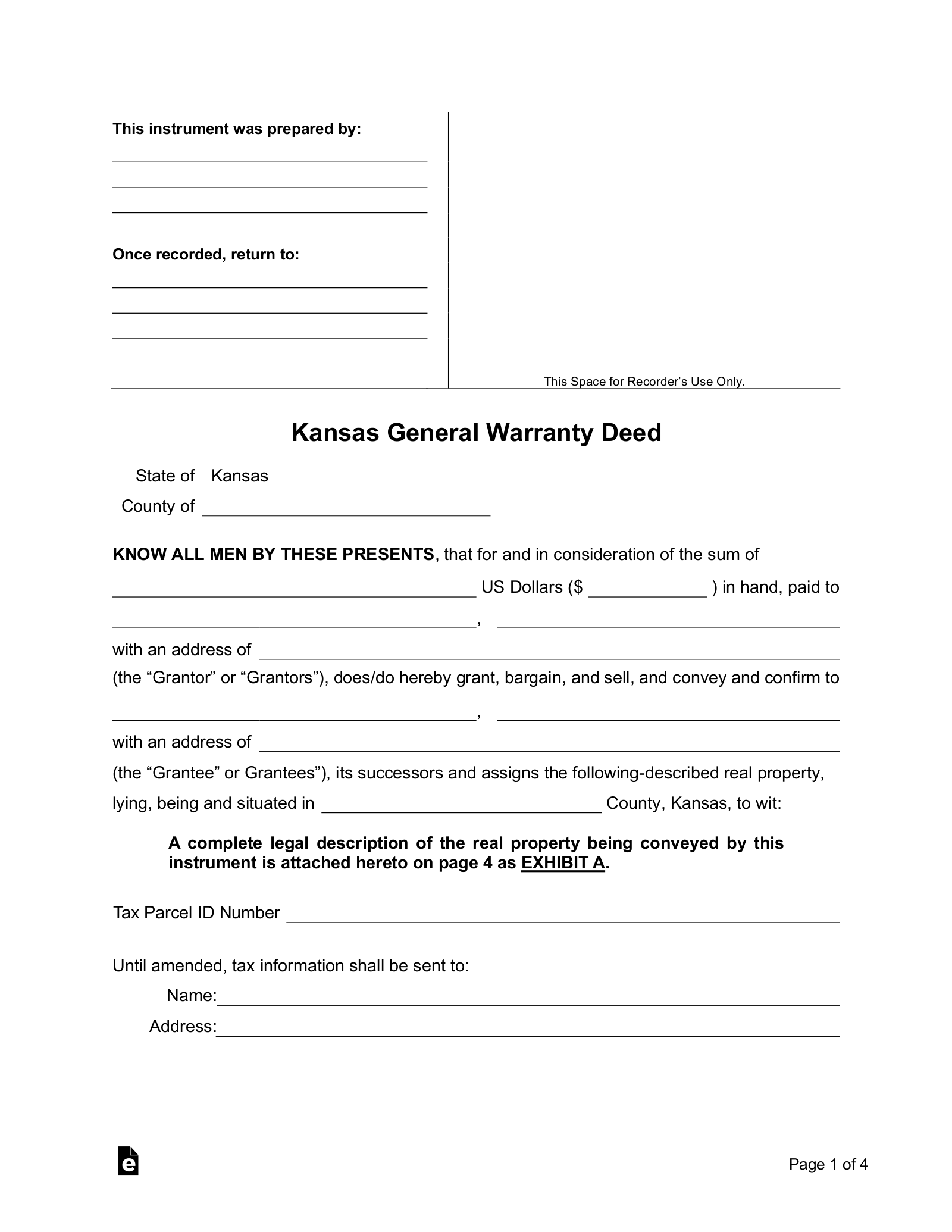

Free Kansas General Warranty Deed Form PDF Word eForms

The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. If any tax due to the state of. New section 1 of the bill, now k.s.a. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Find out if you or your business.

Sample Kansas Warranty Deed Template » Forms 2025

Find out the criteria, fees, options and. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. If any tax due to the state of. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. Learn how to pay, remove your name, or bid on seized.

Sharice Davids Campaign Served with Tax Warrant The Sentinel

(a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. Find out if you or.

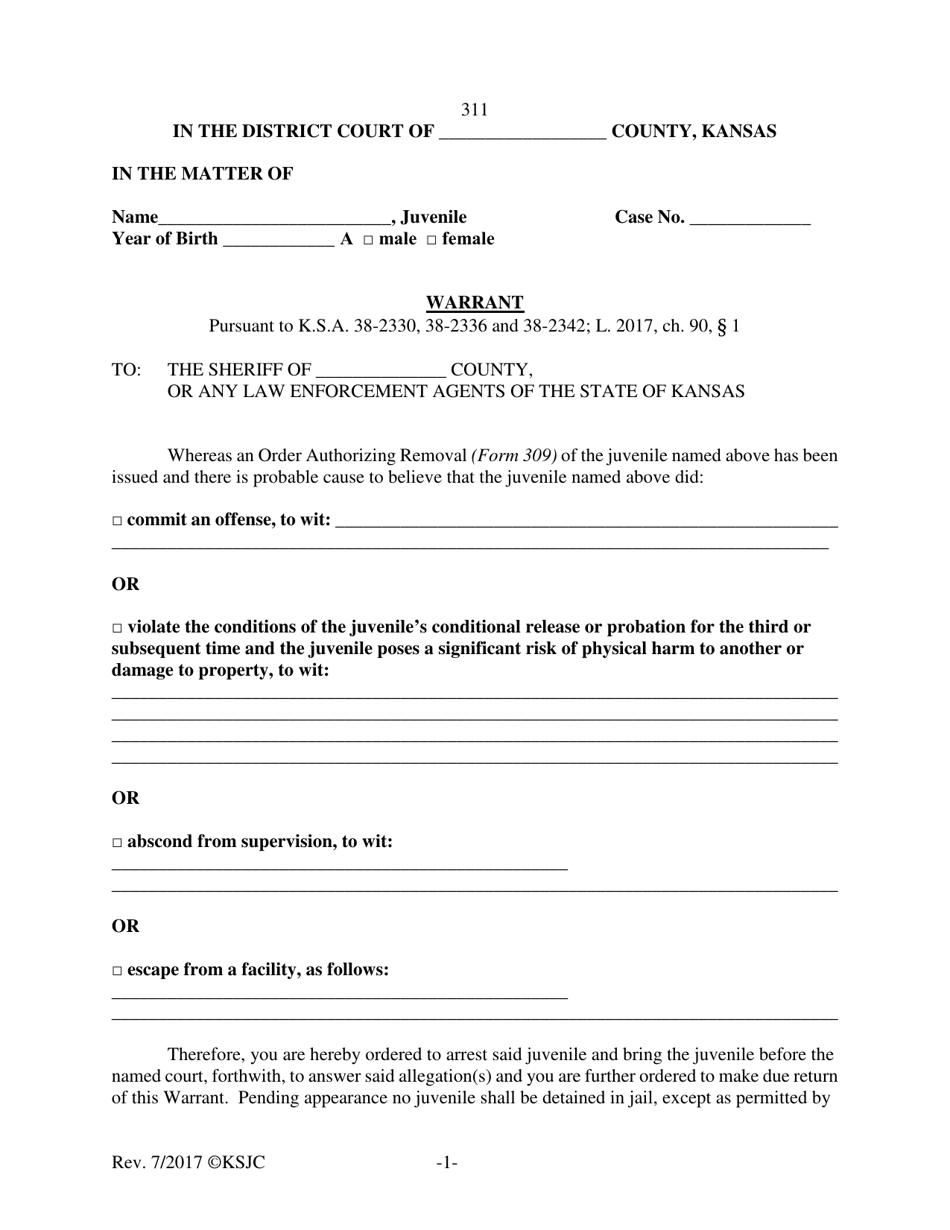

Form 311 Fill Out, Sign Online and Download Printable PDF, Kansas

Find out the criteria, fees, options and. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. New section 1 of the bill, now k.s.a. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Learn how to pay, remove your name, or bid on.

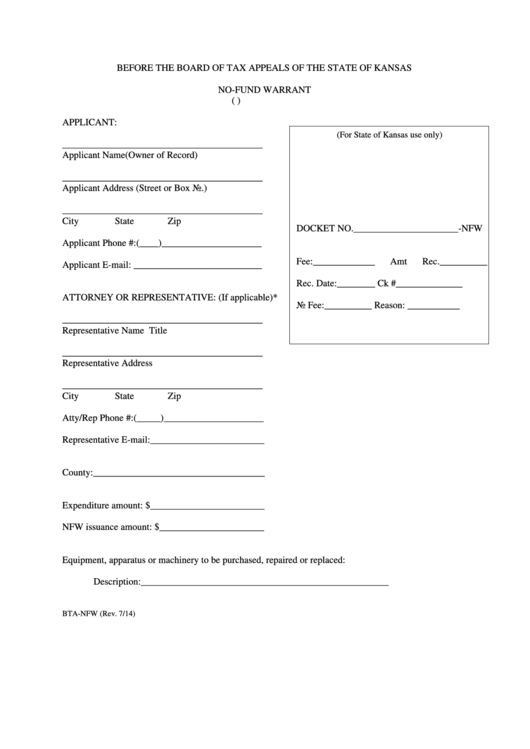

Fillable Form Ksa 12110a Before The Board Of Tax Appeals Of The State

Find out the criteria, fees, options and. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. Learn how to pay, remove your name, or bid on seized items from the.

Tax Warrants — DeKalb County Sheriff's Office

New section 1 of the bill, now k.s.a. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court. (a) whenever a taxpayer liable to pay any tax, penalty or interest.

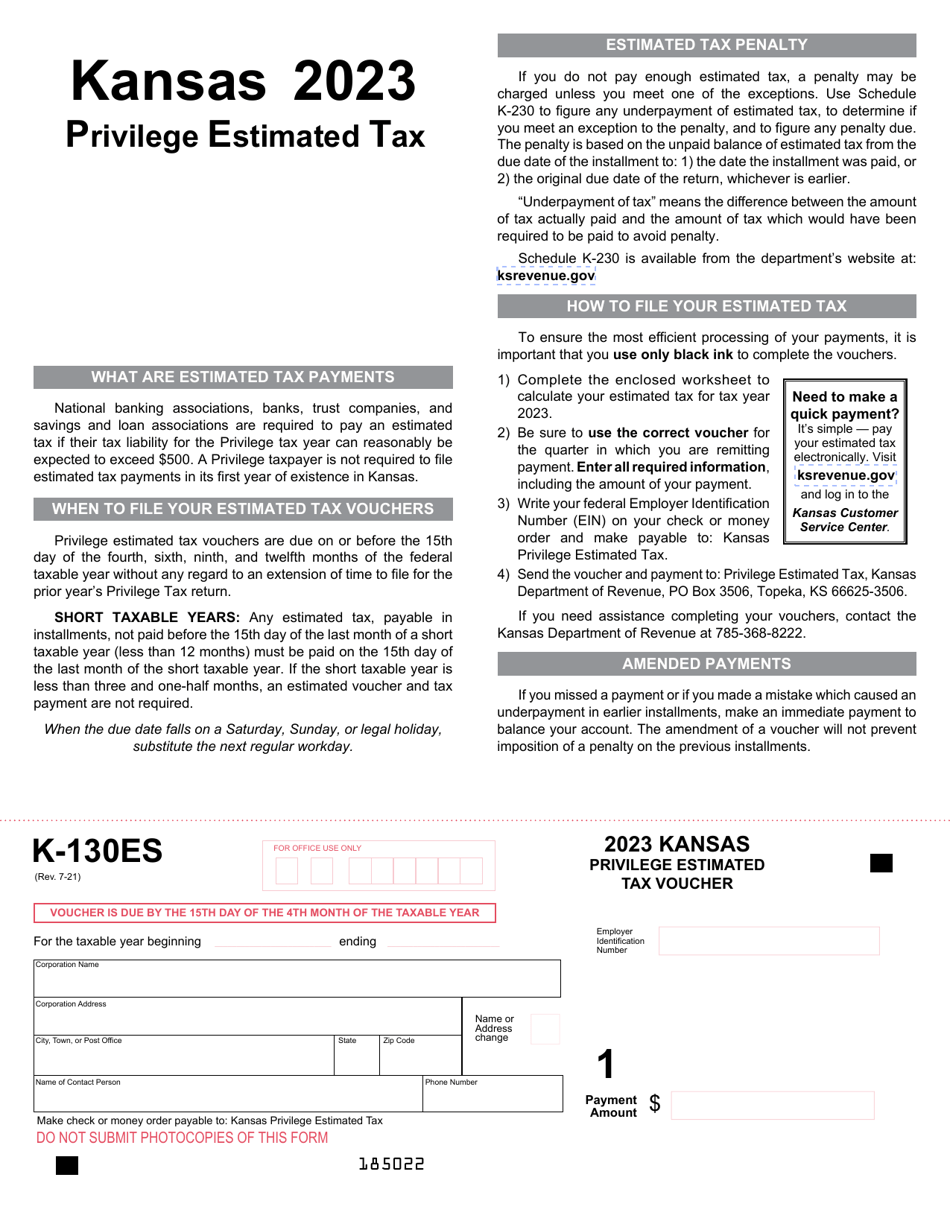

Form K130ES 2023 Fill Out, Sign Online and Download Fillable PDF

Find out if you or your business have unresolved tax debts in kansas. Find out the criteria, fees, options and. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or. If any tax due to the state of. New section 1 of the bill, now k.s.a.

Form CTANFW Download Fillable PDF or Fill Online NoFund Warrant

Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. (a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. New section 1 of the bill, now k.s.a. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the.

Find Out The Criteria, Fees, Options And.

(a) whenever a taxpayer liable to pay any tax, penalty or interest assessed pursuant to k.s.a. Tax warrants are filed by the kansas department of revenue for recovery of delinquent tax obligations. Learn how to request a payment plan for your tax debt and avoid a tax warrant in kansas. The kansas department of revenue (kdor) can issue a tax warrant when a taxpayer fails to pay assessed taxes, penalties, or.

Find Out If You Or Your Business Have Unresolved Tax Debts In Kansas.

New section 1 of the bill, now k.s.a. If any tax due to the state of. Learn how to pay, remove your name, or bid on seized items from the tax. Learn how to resolve a tax warrant issued by the kansas department of revenue and recorded with the court.