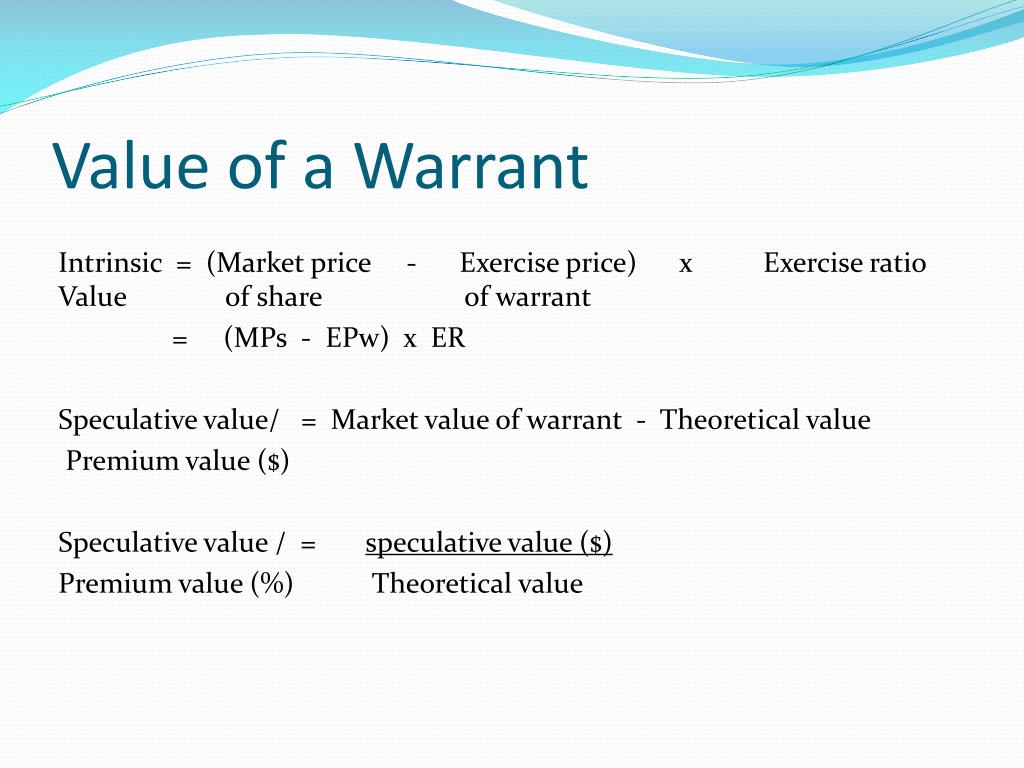

Valuing A Warrant - A stock warrant grants you the right to buy stock at a certain price on a specific date. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. If this is a moonshot type company (i.e. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. There's not going to be a perfect answer for this. To determine the value of a warrant, you must. They will either go broke or be.

There's not going to be a perfect answer for this. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. A stock warrant grants you the right to buy stock at a certain price on a specific date. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. To determine the value of a warrant, you must. They will either go broke or be. If this is a moonshot type company (i.e.

Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. If this is a moonshot type company (i.e. There's not going to be a perfect answer for this. To determine the value of a warrant, you must. They will either go broke or be. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. A stock warrant grants you the right to buy stock at a certain price on a specific date.

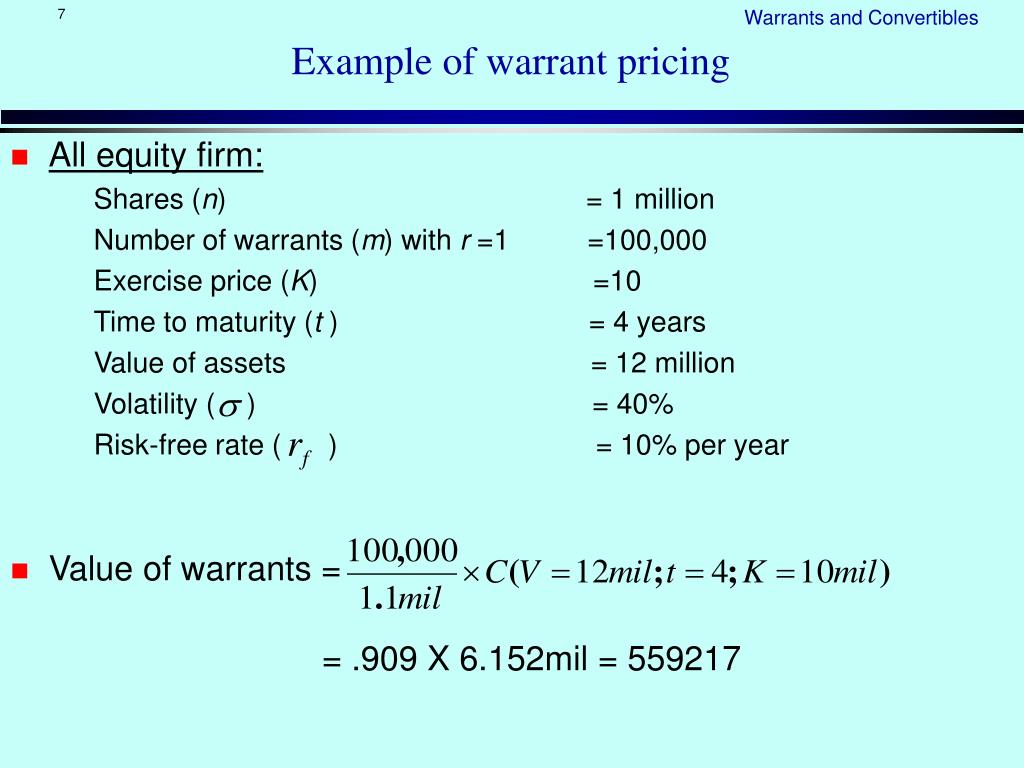

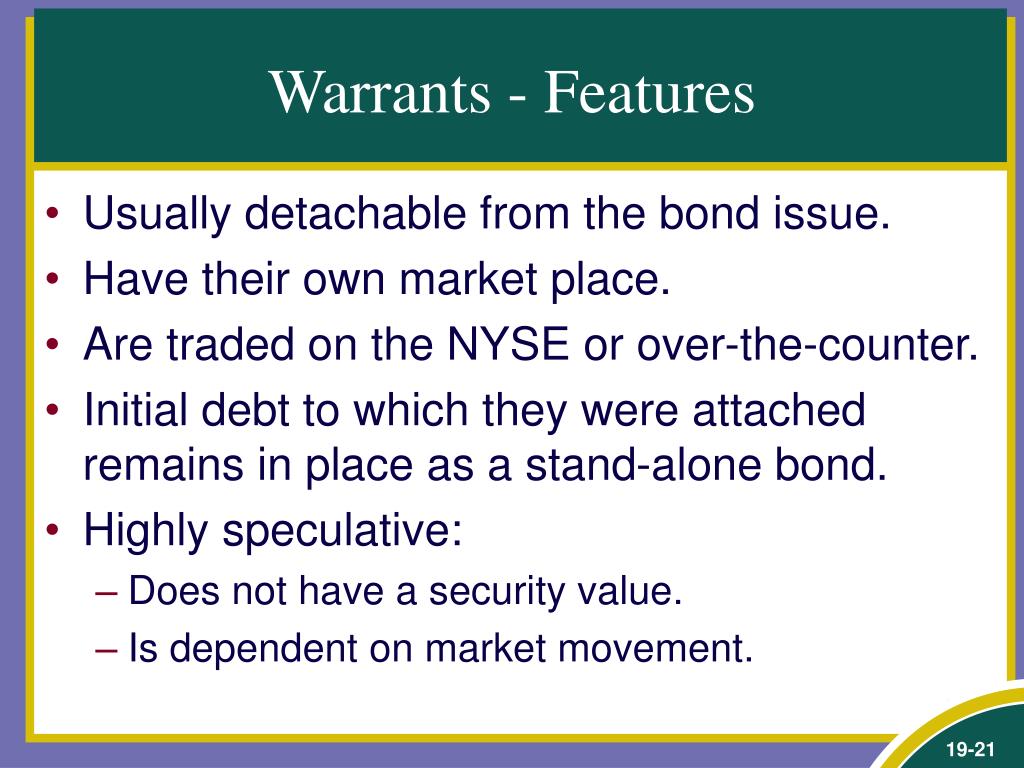

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

A stock warrant grants you the right to buy stock at a certain price on a specific date. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To calculate the warrant.

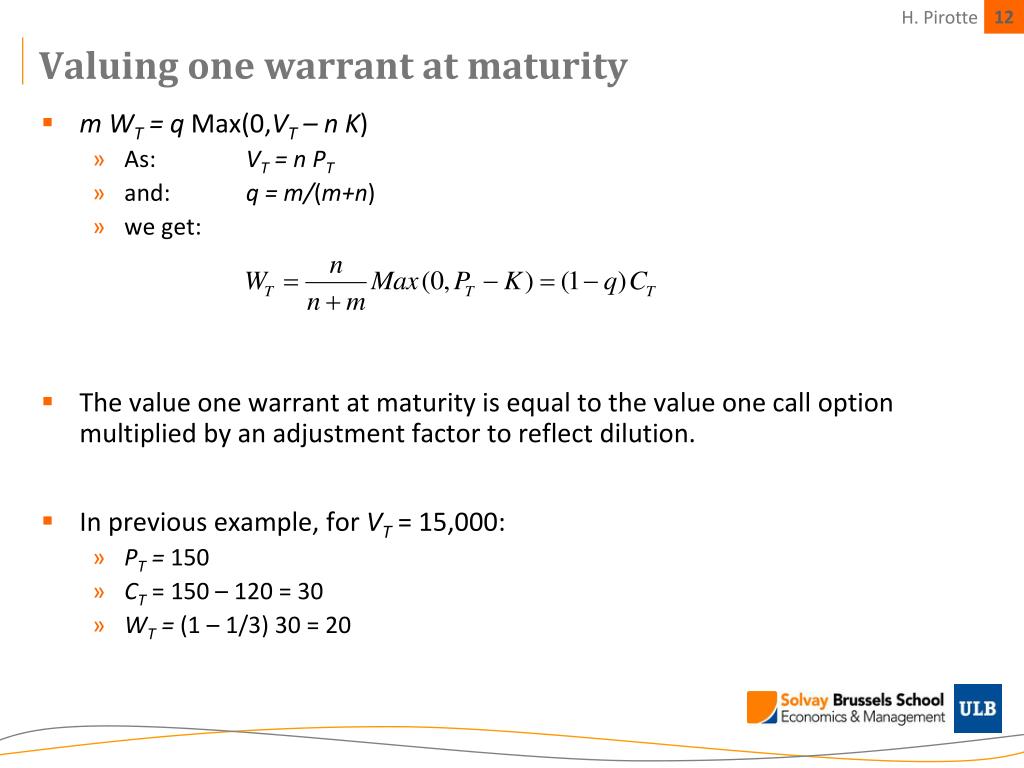

PPT Corporate Valuation and Financing PowerPoint Presentation, free

To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. If this is a moonshot type company (i.e. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. There's not going to be a perfect.

PPT Chapter 11 PowerPoint Presentation, free download ID3790721

To determine the value of a warrant, you must. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. They will either go broke or be. To value a warrant, it is.

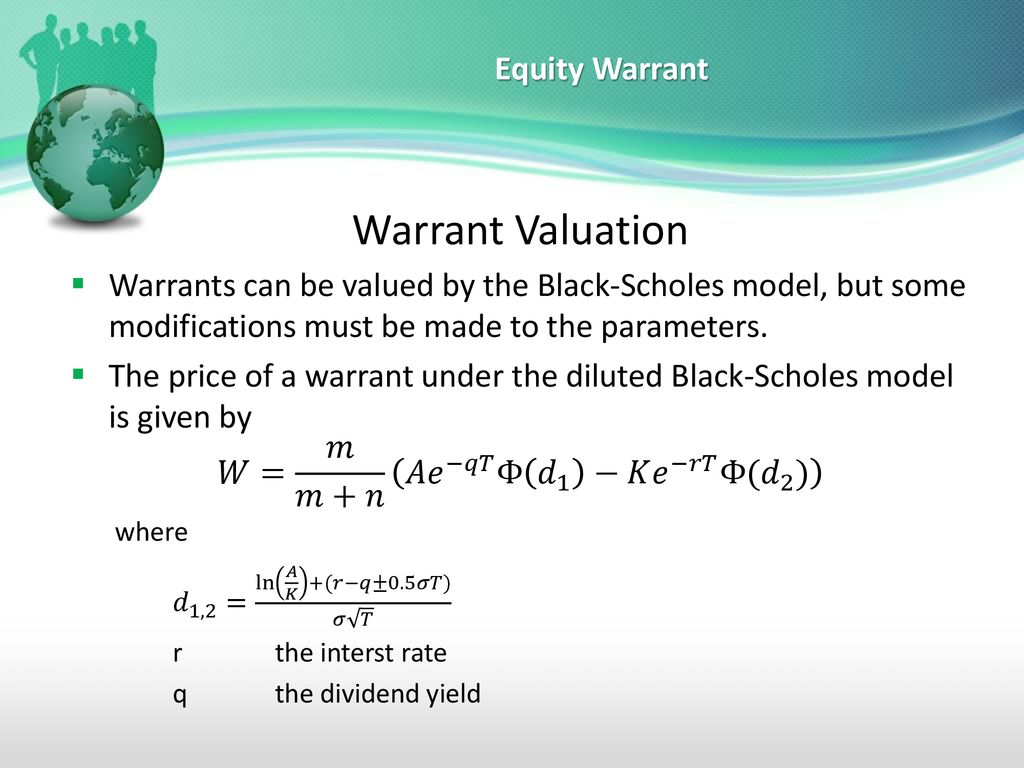

Equity Warrant Difinitin and Pricing Guide ppt download

Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. There's not going to be a perfect answer for this. If this is a moonshot type company (i.e. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To determine the value.

How Long Does It Take for a Warrant To Be Issued? Criminal Lawyer News

A stock warrant grants you the right to buy stock at a certain price on a specific date. If this is a moonshot type company (i.e. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. The two main rules to account for stock warrants are that the issuer.

Equity Warrant Difinitin and Pricing Guide ppt download

To determine the value of a warrant, you must. They will either go broke or be. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To value a warrant, it is.

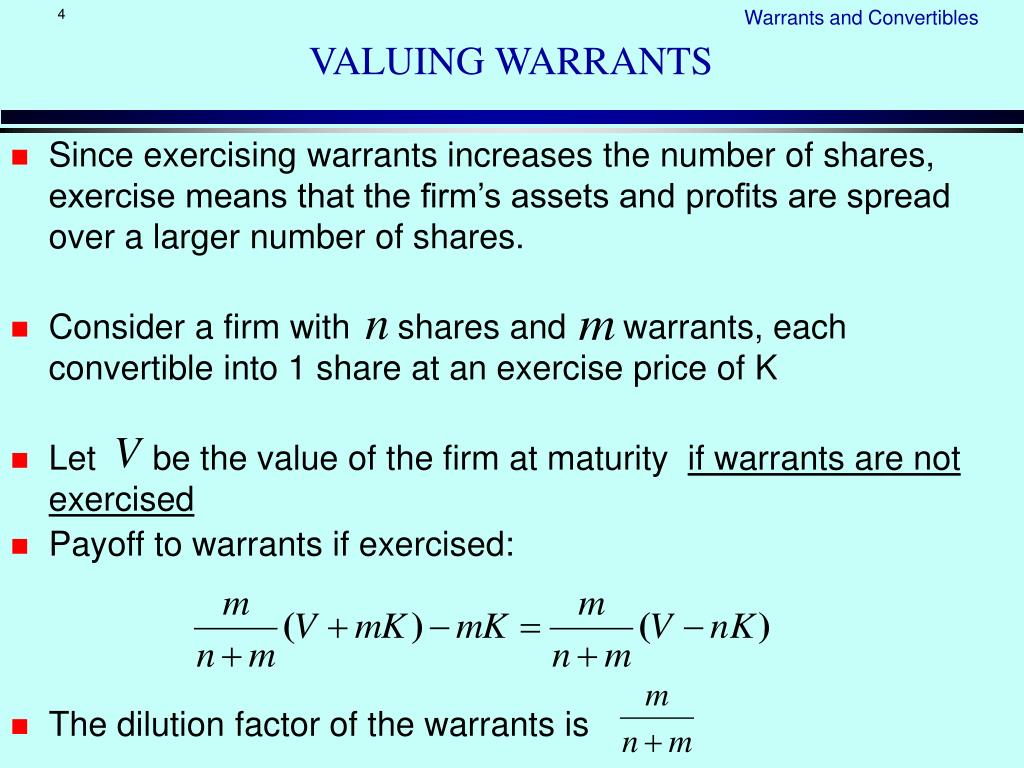

PPT Warrants and Convertibles PowerPoint Presentation, free download

There's not going to be a perfect answer for this. They will either go broke or be. A stock warrant grants you the right to buy stock at a certain price on a specific date. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. The.

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To determine the value of a warrant, you must. To value a warrant, it is crucial to consider several factors, including the underlying stock price, strike price, time to expiration,. If this is a moonshot type company (i.e. There's not going to be a perfect.

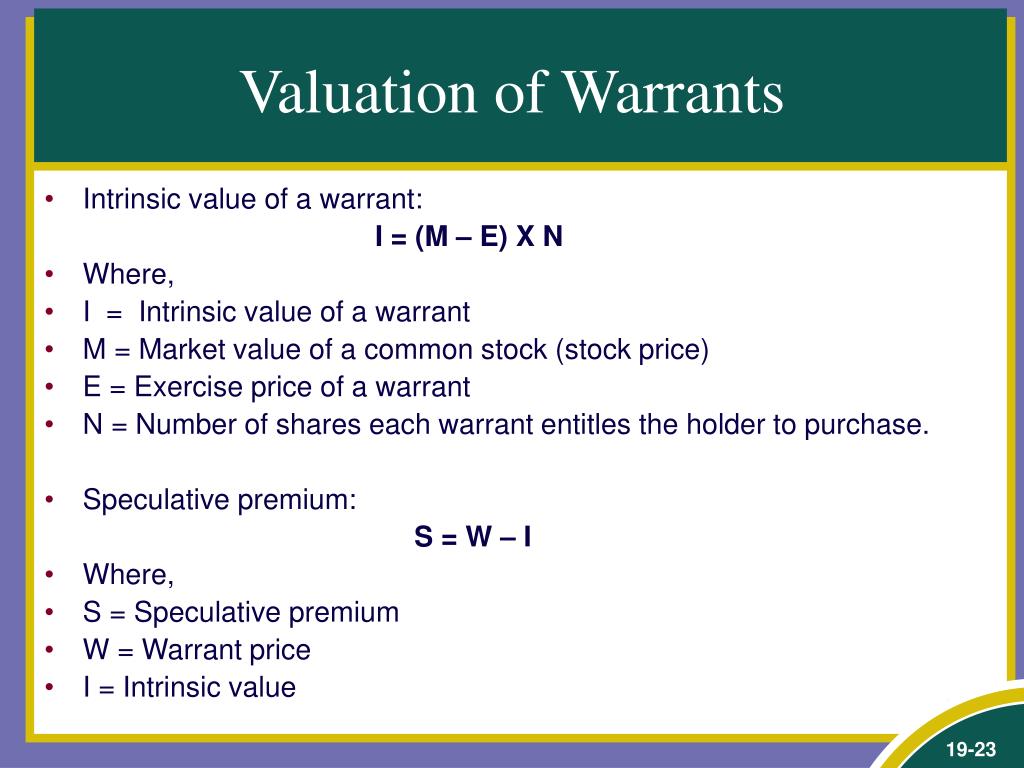

Learning Objectives Calculate the conversion value of a convertible

A stock warrant grants you the right to buy stock at a certain price on a specific date. If this is a moonshot type company (i.e. There's not going to be a perfect answer for this. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To determine the value of a warrant, you must.

PPT Warrants and Convertibles PowerPoint Presentation, free download

They will either go broke or be. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To determine the value of a warrant, you must. There's not going to be a.

To Value A Warrant, It Is Crucial To Consider Several Factors, Including The Underlying Stock Price, Strike Price, Time To Expiration,.

A stock warrant grants you the right to buy stock at a certain price on a specific date. They will either go broke or be. There's not going to be a perfect answer for this. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting.

To Calculate The Warrant Value, Subtract The Strike Price From The Current Market Price To Determine The Intrinsic Value (If Positive), Then Add The.

The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued. To determine the value of a warrant, you must. If this is a moonshot type company (i.e.

.jpg)

+x+N.jpg)