Warrant Meaning Finance - Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another.

Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date.

Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Warrants are traded as securities whose price reflects the value of the underlying stock.

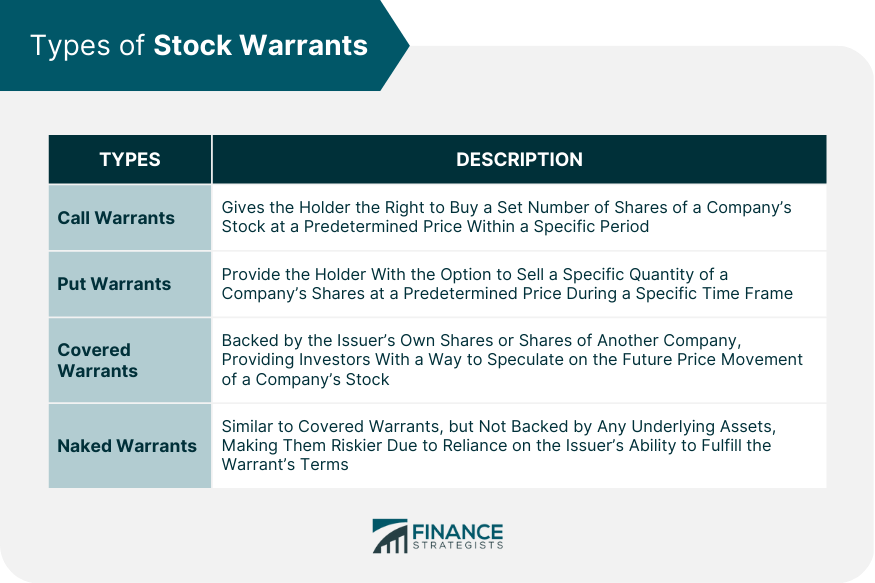

Derivative Warrants Explained Types and Example

Warrants are traded as securities whose price reflects the value of the underlying stock. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Corporations often bundle warrants with another.

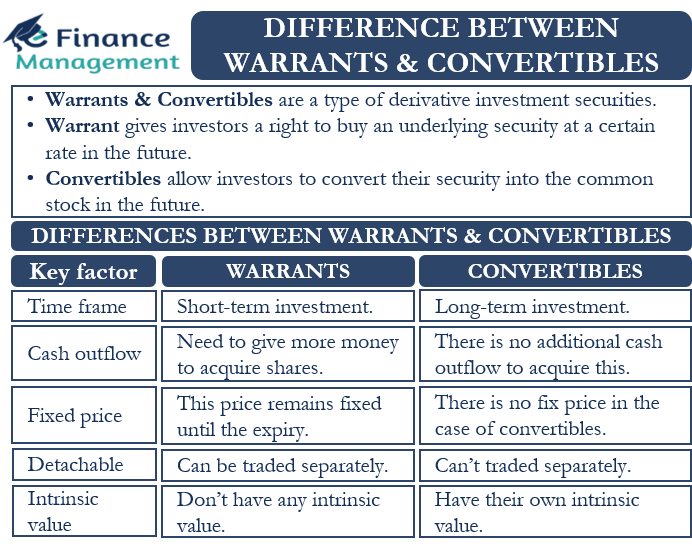

Difference Between Warrants and Convertibles eFinanceManagement

Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Warrants are traded as securities whose price reflects the value of the underlying stock.

Warrant Definition

Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date.

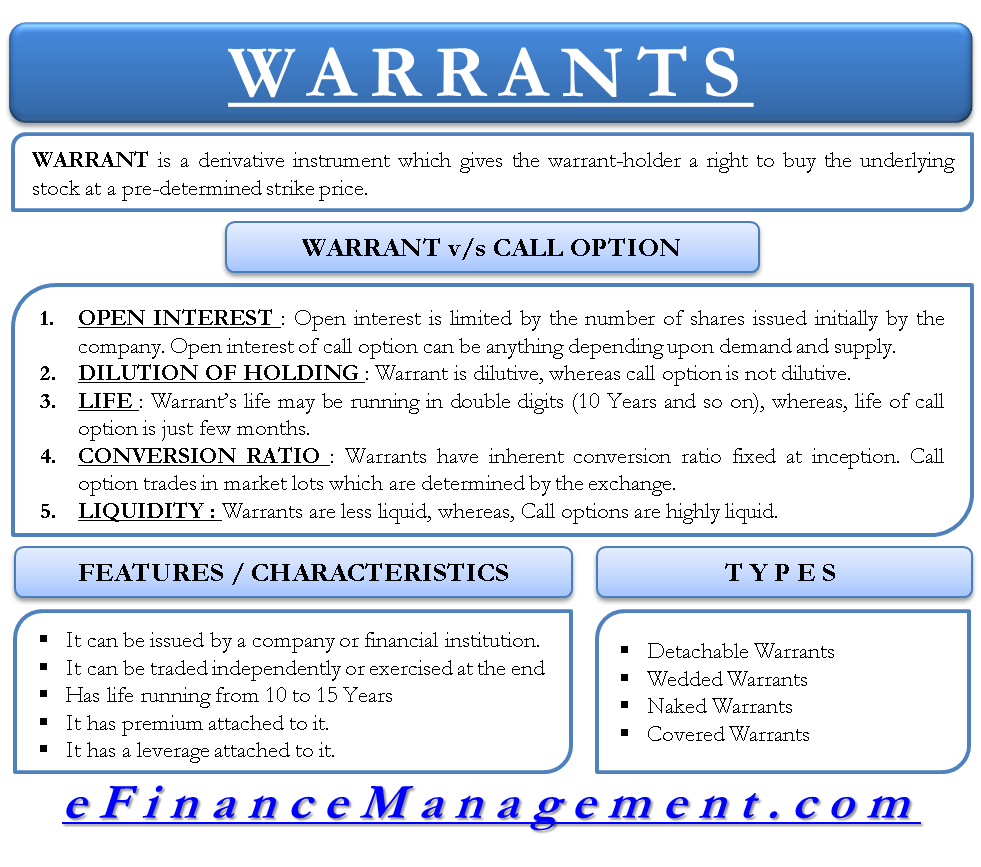

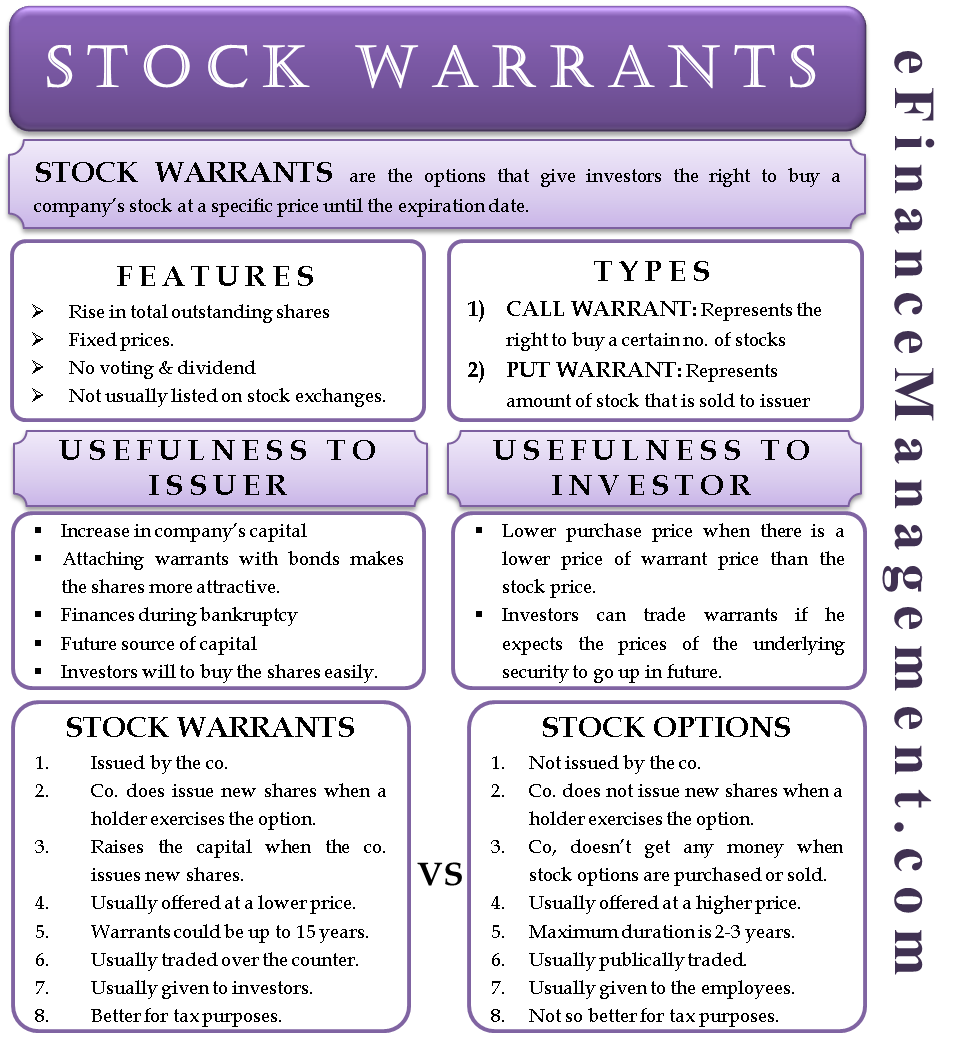

Warrant Define, Vs Options, Features Types eFinanceManagement

Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date.

What Is The Difference Between A Stock And A Warrant at John Brundage blog

Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Corporations often bundle warrants with another. Warrants are traded as securities whose price reflects the value of the underlying stock.

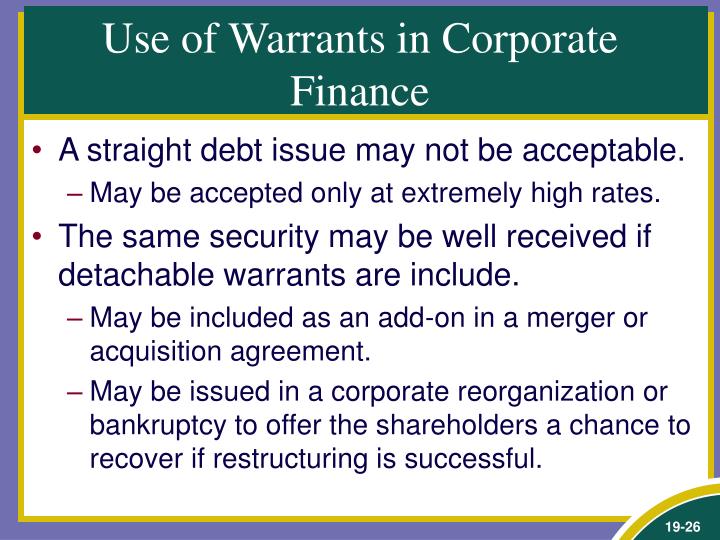

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

Warrants are traded as securities whose price reflects the value of the underlying stock. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Corporations often bundle warrants with another.

What Is a Stock Warrant? Definition, Types & Example TheStreet

Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date.

Characteristics and Role of warrants EBC Financial Group

Warrants are traded as securities whose price reflects the value of the underlying stock. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Corporations often bundle warrants with another.

Stock Warrants Features, Types, Benefits, Stock Options And More

Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date.

Warrant Overview, Stock Warrant, and Examples

Warrants are traded as securities whose price reflects the value of the underlying stock. Warrants are securities that give the holder the right to buy or sell a specific quantity of shares or bonds at a fixed price before a certain date. Corporations often bundle warrants with another.

Warrants Are Securities That Give The Holder The Right To Buy Or Sell A Specific Quantity Of Shares Or Bonds At A Fixed Price Before A Certain Date.

Warrants are traded as securities whose price reflects the value of the underlying stock. Corporations often bundle warrants with another.

:max_bytes(150000):strip_icc()/Warrant-00caae50e5e9440e96dbef0645750b1b.jpg)

:max_bytes(150000):strip_icc()/Wiener_Riesen_Rad_Ltd_1898-41accd5aa0f9438198764c26178b58cb.jpg)