What Is A Tax Warrant Oklahoma - When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt.

When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the.

A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt.

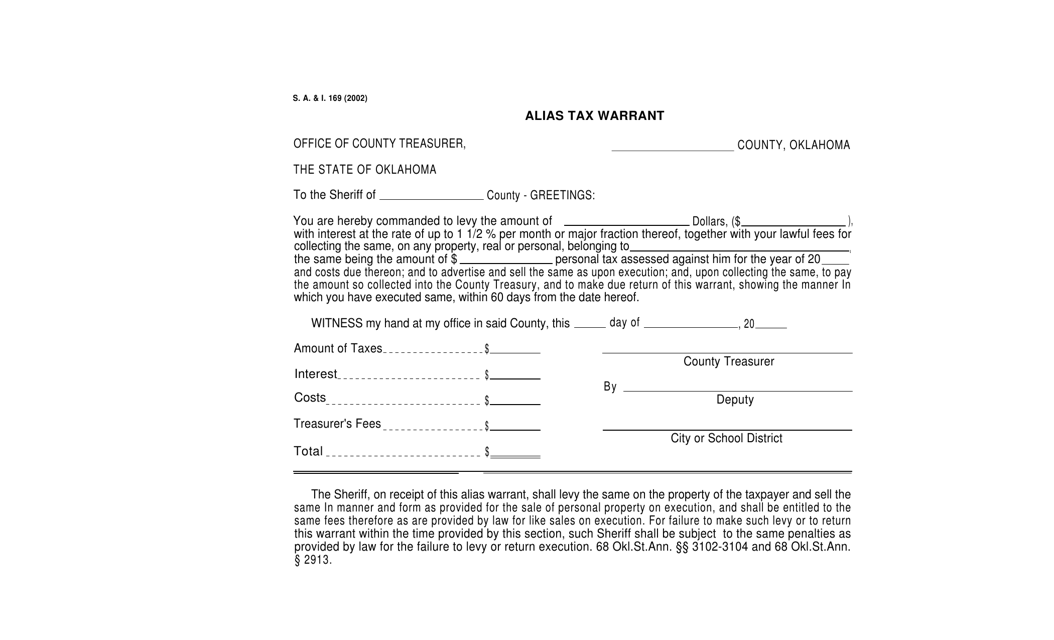

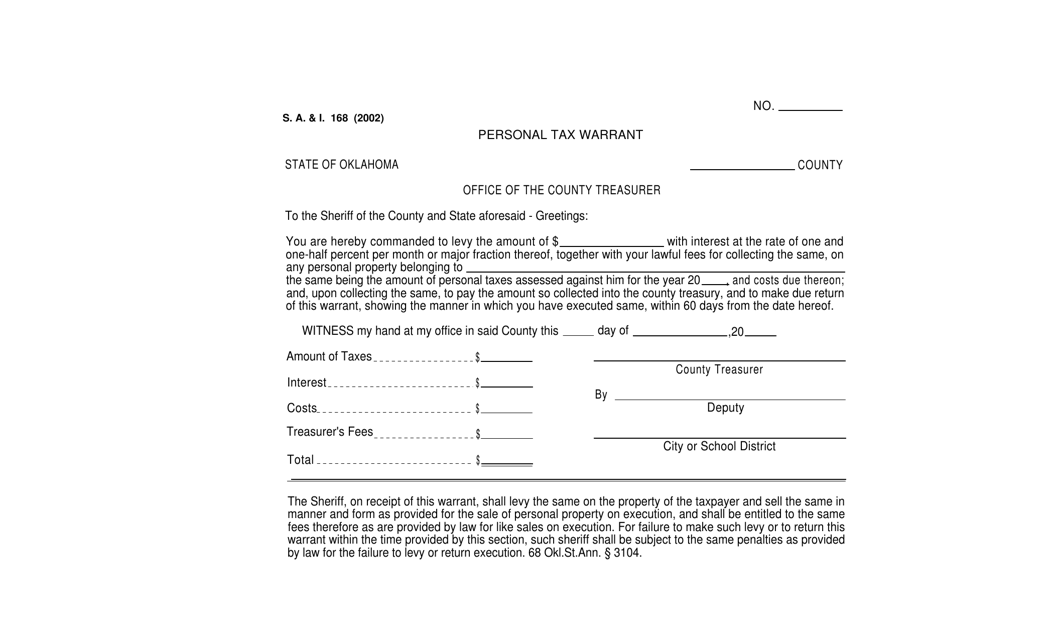

Form S.A.& I.169 Fill Out, Sign Online and Download Printable PDF

A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a.

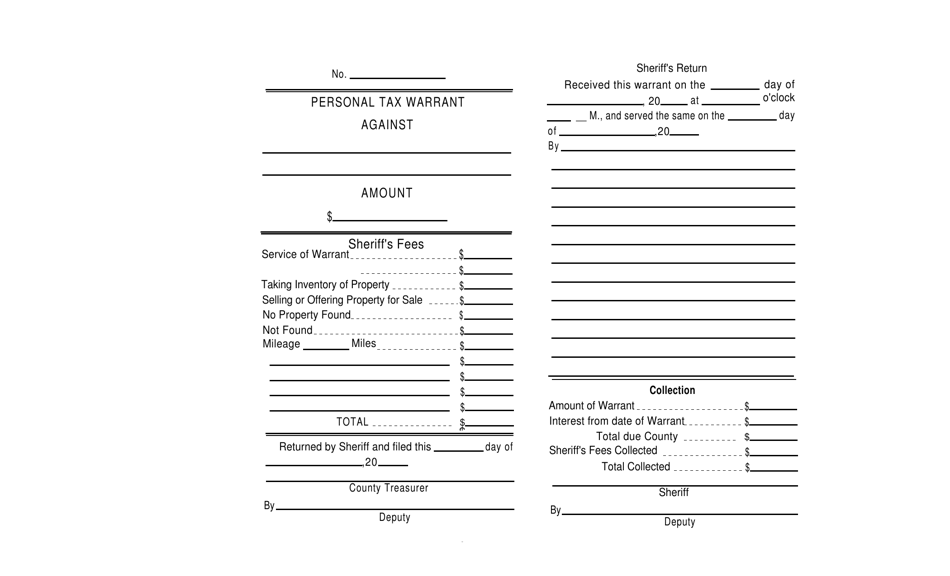

Warrant Taxpayer Taxes

A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a.

What Happens When A Tax Warrant Is Issued? Beem

When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax.

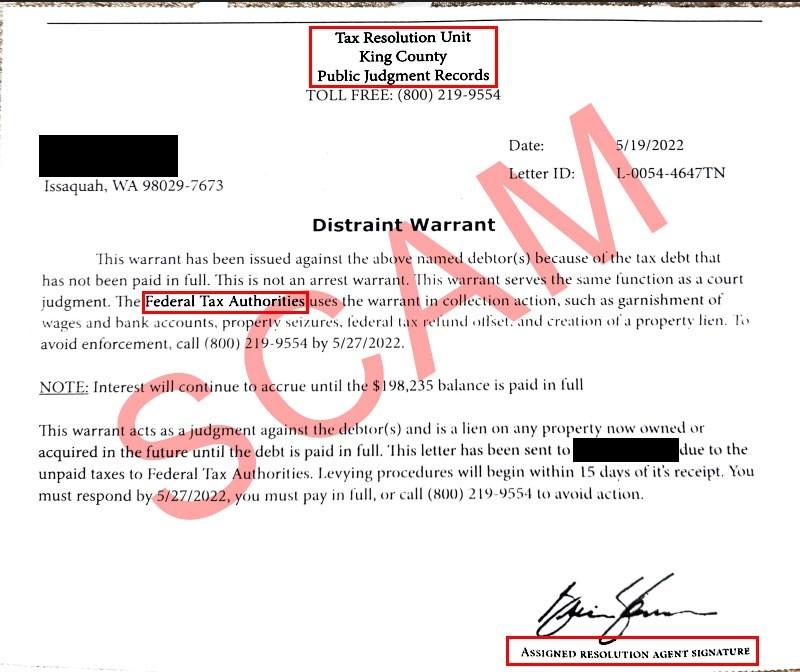

Judgement Records Search

The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed.

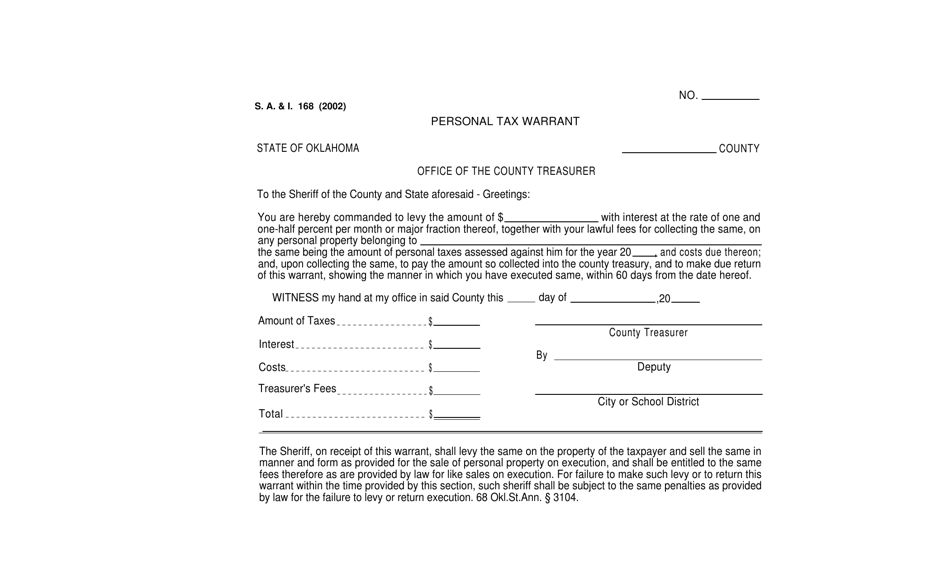

Form S.A.& I.168 Fill Out, Sign Online and Download Printable PDF

When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest.

Form S.A.& I.168 Fill Out, Sign Online and Download Printable PDF

The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to.

Form S.A.& I.168 Fill Out, Sign Online and Download Printable PDF

In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving.

Tax Warrants — DeKalb County Sheriff's Office

In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving.

Oklahoma Warranty Deed from Individual to Husband and Wife How To Add

The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to.

Verify a Refund Check

A tax warrant in oklahoma is issued when an individual or business fails to pay state taxes owed to the oklahoma tax commission. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest.

A Tax Warrant In Oklahoma Is Issued When An Individual Or Business Fails To Pay State Taxes Owed To The Oklahoma Tax Commission.

When any oklahoma tax is not paid in full before it becomes delinquent, the oklahoma tax commission may immediately issue an official. In certain circumstances, the oklahoma tax commission (or the irs) can foreclose on your property to satisfy a tax debt. The tax warrant shall command the sheriff to collect the amount due for unpaid taxes, penalties and interest thereon, cost of advertising,. A tax warrant in oklahoma is essentially a legal document issued by the oklahoma tax commission (otc) giving the.